As Bondsavvy’s subscriber base has grown, so too has the corporate bond trading activity following our investment recommendations. We estimate our subscribers

can account for over 90% of customer buy trades in our recommended bond CUSIPs on the days we make initial buy recommendations. In addition, our recommendations

have driven substantial volume increases in the corporate bond CUSIPs we recommend, including a 1,851% increase in the customer buy dollar volume traded

for one bond we recommended September 23, 2020. This article contains case studies evaluating the impact on corporate bond trading volumes and corporate

bond prices of five Bondsavvy corporate bond recommendations made in 2020.

Our goal is for Bondsavvy subscribers to be able to purchase newly recommended bonds at or near our recommended price. In 2020, as Bondsavvy-driven trading volumes increased, we took decisive actions to limit the market impact of our corporate bond recommendations. These actions have been successful to date, and we written several blog posts that compare our pick date prices to the prices of recommended bonds shortly after the pick date. These corporate bond blog posts include:

Best Bonds to Buy 2024

Best Bonds to Buy 2023

A key change we made since 2020 was to move The Bondcast, our subscriber webcast where we present new bond recommendations, to 5:00pm Eastern Time, after bond markets close. This and other initiatives have enabled Bondsavvy-subscriber trades to trickle in during the days following The Bondcast.

KEY TAKEAWAYS FROM THIS CORPORATE BOND TRADING BLOG POST

For the first 60+ initial buy recommendations Bondsavvy made over its first three years, our recommendations typically did not have an immediate, material

impact on bond prices. When the prices of two new Bondsavvy corporate bond recommendations increased 5+ points within 30 minutes of our December

17, 2020 recommendation, however, we began assessing the extent of the problem and what we could do to limit the immediate pricing impact of our bond recommendations.

We analyzed the volume and price increases of 30 recent Bondsavvy recommendations and selected the trading activity of five bonds to profile in this article's

case studies. Below are key takeaways from these five corporate bond trading case studies:

- Prior to our recommendations, our recommended corporate bonds often recorded fewer than five customer buy trades per day.

- Our bond recommendations often catapult these thinly traded bonds into the 10 most actively traded investment-grade and high-yield corporate bonds

on our recommendation dates.

- The corporate bond market has typically done a good job absorbing the new Bondsavvy-driven trades; however, for certain bonds, such as the one reviewed

in Case Study 3, the bond price spiked 5 points following 45 customer buy orders totaling $1.3 million in face value.

- We need to plan for the day when Bondsavvy-subscriber orders drive even more significant customer buy or customer sell orders over a short time period.

- Bondsavvy has taken actions to limit the impact our recommendations have on the prices of our recommended bonds.

- Limiting the market impact caused by new bond recommendations would increase individual-investor confidence that they are getting a fair deal when

trading. This could bolster investor adoption of individual corporate bonds, an asset class that accounts for less than 1% of US investor portfolios

in spite the advantages of individual bonds vs. bond funds and stocks.

OVERVIEW OF BOND RECOMMENDATION CASE STUDIES

The case studies covered in this fixed income blog post include the five bonds summarized in Figure 1, where we show the recommendation date, bond rating, and the corporate bond trading volume increases driven by our recommendations.

Note that we are only revealing the identity of one of the bonds in the five case studies. We recently added a new sample edition of The Bondcast, and the Kirby 4.20% '28 bond (CUSIP 497266AC0) is in that

webcast. Investors will need to subscribe to Bondsavvy to

learn all of our bond recommendations, including the other four below:

Figure 1: Summary of Our Five Case Studies

| |

Pick Date |

|

Rating |

|

Increase in #

of Buy Trades* |

|

$ Volume

Increase* |

| Case Study 1 |

Dec 17 '20 |

|

Investment Grade |

|

700% |

|

825% |

| Case Study 2 (Kirby 4.20% '28) |

June 5 '20 |

|

Investment Grade |

|

330% |

|

488% |

| Case Study 3 |

Dec 17 '20 |

|

High Yield |

|

1600% |

|

104% |

| Case Study 4 |

Sep 23 '20 |

|

High Yield |

|

655% |

|

3% |

| Case Study 5 |

Sep 23 '20 |

|

Investment Grade |

|

508% |

|

1851% |

* Volume increases represent the volumes from the pick date plus the following two trading days vs. the three trading days that preceded the pick date.

WHY WE WROTE THIS ARTICLE

Bondsavvy's mission is to empower individual investors to invest in individual corporate bonds. We do this by making corporate bond investment

recommendations throughout the year that our subscribers use when deciding which bonds to buy and when to sell bonds previously recommended. View our corporate bond returns page to see how a select portfolio of

individual corporate bonds can outperform the leading bond funds and ETFs.

From our first set of corporate bond recommendations on September 26, 2017 and through December 17, 2020, BondSavvy has presented initial buy recommendations

for over 65 individual corporate bonds. While we have driven significant corporate bond trading volume increases in our recommended bonds, our immediate

impact on the prices of recommended bonds was generally limited.

On December 17, 2020, however, two of our recommended bonds increased approximately five points within the first hour of trading following the presentation

of our new recommendations, and customers lit up our switchboard, as shown in Figure 2. This was a bad outcome for many Bondsavvy subscribers, and we have

taken action to address this issue. Our goal is to maximize the total returns our

subscribers achieve from investing in corporate bonds we recommend. A key part of this is doing everything we can to ensure Bondsavvy subscribers purchasing

bonds during the days we recommend new bonds can buy bonds at or near our recommended purchase prices.

We review the volume and bond price increase driven by this December 17, 2020 recommendation in Case Study 3.

Figure 2: BondSavvy's Customer Service Switchboard on December 17, 2020

BONDSAVVY'S IMPACT ON CORPORATE BOND TRADING ACTIVITY

According to FINRA TRACE corporate bond trading data, the #10 most actively traded investment-grade and high-yield corporate bonds traded, on average,

60 and 51 times per day during Q3 2020, respectively. These figures aggregate customer buy, customer sell, and dealer-to-dealer trade legs.

In Q3 2020, customer buy trades accounted for 34% and 31% of total investment-grade and high-yield corporate bond trades, respectively. Therefore,

the implied daily customer buy trades for the #10 most active investment-grade and high-yield corporate bonds were 20 and 16, respectively.

The bonds in our five case studies reported between 45 to 81 customer buy trades on our recommendation dates. We therefore believe our recommended

bonds are firmly within the 10 most active bonds traded during our bond pick dates. As shown in our case studies, trading prior to our picks was

limited, so it is our subscriber buy orders that are driving our recommended CUSIPs to be among the top 10 most active on our bond pick dates.

When Bondsavvy presents new bond recommendations during The Bondcast,

we typically recommend between four to five new bonds. As Bondsavvy continues to grow, our recommendations could be the top 4 or 6 corporate

bonds traded on days we recommend new corporate bonds.

Trends in corporate bond trading volumes

As shown in Figure 3a, the number of corporate bond trades below $100,000 in face value fell during Q3 2020. For investment-grade and high-yield

corporate bonds, these trading volumes fell 10% and 16% vs. Q3 2019, respectively. Trades below $100,000 in face value are the domain or the individual

investor, where the average trade size is approximately $20,000 in bond face value.

While trades under $100,000 do not count for a large portion of overall dollar volume traded, in Q3 2020, these trades accounted for 63% and 53% of investment-grade

and high-yield corporate bond trades, respectively. Volume growth in smaller trade sizes is important if we hope for retail investor execution quality

to continue to improve.

Our takeaway: Bondsavvy's recommendations have created a new source of corporate bond trading volumes that can grow significantly.

This growth will be driven, in part, by retail investors' adoption of individual corporate bonds, an asset class that represents less than 1% of US investor

portfolios. While corporate bond trade execution has become efficient, as Bondsavvy founder Steve Shaw presented to the SEC, we need to address the issues presented below in Case Study 3

so more individual investors gain confidence that they are getting a fair deal when investing in individual corporate bonds.

Figure 3a: Daily Corporate Bond Trades with Face Value of <$100,000

Source: FINRA TRACE data

FREQUENCY OF BONDSAVVY'S INVESTMENT RECOMMENDATIONS

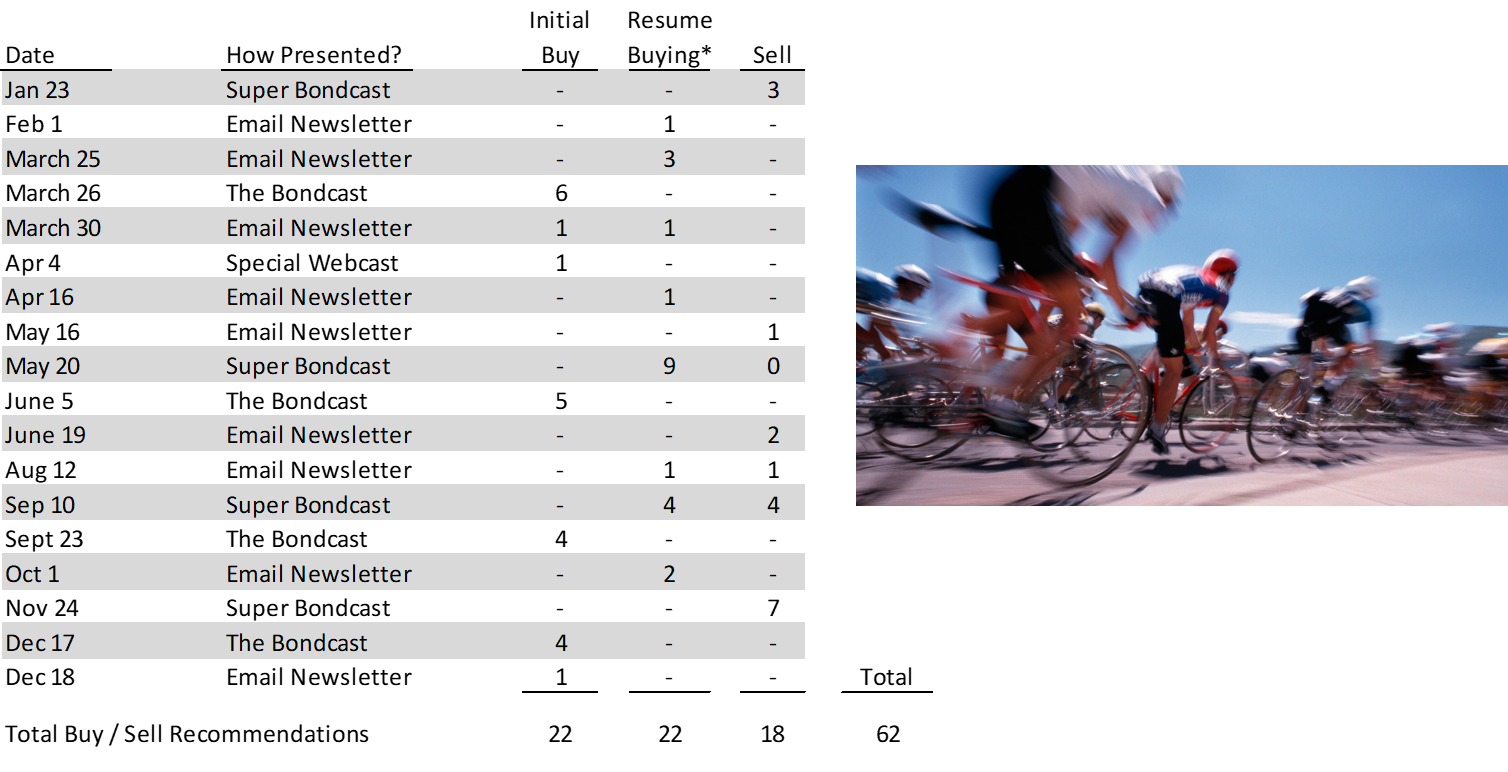

As shown in Figure 3, during 2020, Bondsavvy made 62 buy and sell investment recommendations. These included 22 initial buys, 22 resume buying recommendations,

and 18 sells. We typically make our initial buy recommendations during The Bondcast,

a quarterly subscriber-only webcast where we present new investment recommendations. Also, every quarter, we host The Super Bondcast, where we update

all previous investment recommendations based on the financial performance of our bond issuers and the price performance of each recommended corporate

bond. Throughout the year, we supplement our subscriber webcasts with emailed newsletters that indicate additional changes in our investment recommendations.

One of the key takeaways from Figure 3 is a central point to our bond investment strategy:

to make investments throughout the year as opportunities present themselves. This approach is counter to the conventional wisdom of building return-limiting bond ladders, which invest large sums of money all at once and whenever a bond

matures, regardless of whether it's a compelling time to invest or if the bond presents a compelling value.

The initial buy recommendations we present are bonds we believe can increase in value and generate corporate bond returns that

outperform the leading bond funds and bond ETFs. Since maximizing capital appreciation is our goal, we typically sell bonds before maturity to lock in capital gains and increase total returns.

Figure 3: Cadence of BondSavvy's 2020 Corporate Bond Recommendations

* Occurs when BondSavvy returns a recommendation to a 'buy' after previously making it a 'hold.'

"Cadence" photo licensed from Canva.

CASE STUDIES OF FIVE BONDSAVVY-RECOMMENDED BONDS IN 2020

The five case studies we review below are from the June 5, September 23, and December 17, 2020 editions of The Bondcast subscriber webcast. The goal of the case studies is

to evaluate the impact our recommendations have on corporate bond trading volumes and on the prices of the bonds we recommend. This analysis will inform

initiatives we can take to ensure Bondsavvy's subscribers are able to buy and sell bonds at or near the prices at which we make new buy/sell investment

recommendations.

Since we present The Bondcast on a live subscriber webinar, we typically have a greater concentration of bond trading volumes following The Bondcast than we do after sending recommendations via our investment newsletter. While many of our subscribers execute corporate bond trades on the pick date, others may wait several days prior to making a trade. As a result, when we show our corporate bond trading charts, you'll see volume typically remains at elevated levels for several trading days following the pick date.

CASE STUDY 1 - INVESTMENT GRADE BOND RECOMMENDED DECEMBER 17, 2020

Bond Trading Volume Impact

In Figure 4, we show a bond we recommended December 17, 2020, which drove 700% and 825%

increases in the number of customer buy trades and dollar volume, respectively. In the graphic, the green bar represents the number of customer buy trades

executed on the pick date. For the three days leading up to the pick date, the average number of daily customer buy trades was 4.7. For the month leading

up to the December 17, 2020 pick date, daily customer buy trades ranged from zero to eight. As there were 81 customer buy trades on the pick date, we estimate

Bondsavvy subscribers accounted for 94% of that day's total customer buy trades, assuming 4.7 trades came from buyers who have yet to subscribe to BondSavvy.

With 81 customer buy trades on the December 17, 2020 pick date, we believe our subscribers' trading activity made this bond among the most actively traded

corporate bonds on this date.

Keep in mind that this bond issuer is one of the best-known companies in the world and the bond's issuance size was well over $1 billion. Given the

prominence of the company and size of the issuance, we would have expected higher levels of bond trading volume prior to Bondsavvy's recommendation date.

While we are accustomed to seeing large increases in the number of trades following our bond recommendations, we did not expect to see an 8x increase in

the dollar volume traded. Bondsavvy's subscribers are either individual investors or financial advisors acting on behalf of individual investors. The average

trade size for a retail investor is approximately 20 bonds, or $20,000 in bond par value; however, given the low minimum quantities of most corporate bond

bid-offer quotes, a significant portion of retail investor trades can be between two to ten bonds.

The increase in dollar volume traded from $2.3 million for the three trading days leading up to the pick date to $21.6 million during the next three days,

including the pick date, shows 'liquidity begetting liquidity,' as larger-sized trades began executing shortly after the initial Bondsavvy-driven trade-count

increase.

Figure 4: Corporate Bond Trading Volumes from Case Study 1 Bond

Source: FINRA TRACE data. $ volume in thousands.

Impact on Bond Price of Recommended Bond

The offer price at which we recommend bonds is typically the best offer price shown on Fidelity.com at the end of the day immediately prior to The Bondcast.

For the Case Study 1 bond, we obtained the offer price at 5:00am EST on December 17, 2020, which is effectively the end-of-day price from the previous

trading day. Per Figure 5, the market price for the bond appears to have fallen between the 5:00am EST price on December 17, 2020 and the initial

prices at which BondSavvy subscribers began buying these bonds at 12:12pm EST.

As shown in Figure 5, 50 customer buy trades ($870,000 in face value) were executed at prices of 96.50 and below between 12:12pm EST and 12:39pm EST.

During this 27-minute span, the customer buy price increased approximately 1.25 points. Our recommended offer price of 96.20 is before bond mark-ups,

which are typically 0.1 points for online brokerages such as Fidelity and E*TRADE.

While we would have liked to have seen less impact from the trades immediately following our recommendation, most Bondsavvy subscribers were able to buy

this recommended bond at or near the 96.20 recommendation price. In addition, this bond is a long-dated investment-grade bond that is sensitive to

changes in US Treasury yields. As a result, when Treasury yields spiked in early January 2021 due to the Georgia US Senate seats going blue, this

bond fell to the low 90s, at which time we alerted Bondsavvy subscribers of the opportunity to buy more of these bonds at a better price.

As nearly all of our subscribers buy bonds online through Fidelity,

E*TRADE, and other online bond trading platforms, we generally see consecutive customer buy trades executing at prices very close to each other.

The reason for this is the low commissions and competitive bid-offer quotes enjoyed by customers who buy bonds online.

This is in stark contrast to the days leading up to the December 17, 2020 pick date, where consecutive customer buy trades often have two-point pricing

differentials due to juicy two-point-and-higher markups related to financial advisor fees charged

by full-service brokerages. In addition, these firms often do not access "Street inventory," or bond quotes provided by third parties. As a

result, customers of many full-service brokerage firms pay excessively high prices for bonds due to the high markups and lack of access to competitive

corporate bond quotes.

Figure 5: Bond Price Movements from Case Study 1 Bond

Source: FINRA TRACE data

(1) We obtained the 96.20 offer price from Fidelity.com at 5:00am EST on December 17, 2020. Between that time and when we recommended the bonds at 12:12am EST, the market appears to have fallen approximately 0.75 points.

CASE STUDY 2 - KIRBY CORP. 4.20% 3/1/28 BOND RECOMMENDED JUNE 5, 2020

Corporate Bond Trading Volume Impact

Of our five case studies, this is the only one where we are revealing the identity of the recommended corporate bond. In this case, it's the Kirby

Corp. 4.20% 3/1/28, which has the CUSIP 497266AC0. We show the name of this bond since we recently added a second sample edition of The Bondcast, where you can see the presentation we made that supported the

Kirby recommendation as well as four other individual corporate bonds. We preview bonds we recommended June 5, 2020 in this blog post.

The Kirby '28 bond is a smaller company bond issuance than Case Study 1, with $500 million outstanding as of the recommendation date. While there

were a larger number of trades in the several days leading up to our June 5, 2020 recommendation date, as shown in Figure 6, beginning April 17, 2020,

there were many trading days where no customer buy trades were reported at all.

On the June 5, 2020 recommendation date, 48 customer buy trades were reported to TRACE, and, based on historical trading volumes, we believe our subscribers

accounted for approximately 86% of these trades. While the number of customer buy trades on the trade date was fewer than those shown in Case Study

1, the next two trading days exceeded the highest number of customer buy trades between April 17 and June 4, 2020. The customer buy dollar volume

increased 488% from $631,000 to $3.7 million for the three-day period beginning on the June 5, 2020 pick date.

Figure 6: Corporate Bond Trading Volumes for Kirby 4.20% '28 Recommendation

Source: FINRA TRACE data. $ volume in thousands.

Impact on Price of Kirby 4.20% '28 Bond

The Kirby '28 bond is an example of how we would like to see bond markets handle an increase in corporate bond trading volumes. The Bondcast on June

5, 2020 was a Friday, and we began our presentation at 10:00am EST. Typically, we begin The Bondcast at noon EST on either Tuesday, Wednesday, or

Thursday. Market volumes are typically lower on Fridays, so that could have resulted in volumes being dispersed across a greater number of trading

days.

In Figure 6 above, 48 of the total 86 customer buy trades executed on the pick date and the next two trading days (55.8%) were executed on the pick date

compared to 81 of 112 (72.3%) in Case Study 1. The handful of trades executed on June 5, 2020 between 97.49-98.67 appear to be corporate bond trades

with high bond markups,

which investors often pay when they have their personal financial advisor execute trades on their behalf. Nearly all Bondsavvy subscribers buy bonds online, and we believe the substantial majority of our customers bought the Kirby bonds at or

near the 96.65 recommendation price. This is evidenced by the large number of trades shown in Figure 7 that occurred on June 5, 2020 and were executed

slightly below the recommended bond purchase price.

Figure 7: Bond Price Movements of Kirby 4.20% '28 Bond Pick

Source: FINRA TRACE data

CASE STUDY 3 - HIGH-YIELD CORPORATE BOND RECOMMENDED DECEMBER 17, 2020

Bond Trading Volume Impact

Our corporate bond for Case Study 3 is Bond Recommendation 3 shown in this preview of

our December 17, 2020 edition of The Bondcast.

As was the case with our first two case studies, the number of customer buy trades leading up to the recommendation date was minimal, with only seven trades

during the three trading days leading up to the pick date. Bondsavvy subscribers then drove a 1,600% surge in the number of customer buy trades,

and a 104% increase in dollar volume, as shown in Figure 8. Based on the average 2.3 daily trades leading up to the pick date, we estimate our subscribers

accounted for 97% of customer buy trades on the pick date.

Figure 8: Corporate Bond Trading Volumes from Case Study 3 Bond

Source: FINRA TRACE data. $ volume in thousands.

Impact on Price of Recommended Bond

According to the TRACE Fact Book, in Q3 2020, there were an average of 19,928 daily customer buy trades. Generally, online bond trading platforms have

live quotes for approximately 9,000 corporate bond CUSIPs. Based on these numbers, the average corporate bond had 2.3 customer buy trades each day in Q3 2020.

This number isn't exact, as there can be volume in bonds without live quotes; however, it's in the ballpark. This 2.3 daily customer buy trades

is the same number the bond in Case Study 3 had for the three days leading up to our December 17, 2020 pick date. We then had the number of customer

buy trades increase to 76 on the pick date.

So what happened to the price of this bond in the wake of our recommendation?

Figure 9 shows the bond price movements for the Case Study 3 bond from November 9, 2020 until December 22, 2020. While our presentation began

at noon EST on December 17, 2020, we didn't reveal the CUSIPs of the recommended bonds until 12 minutes later, at which time our subscribers began

purchasing these bonds. From 12:12pm until 12:34pm EST, the market worked the way we hoped it would, with 45 customer buy trades executed between

our 83.00 recommended offer price and 84.09. During this time, investors bought $1.3 million in face value of these company bonds.

Following these trades, however, 20 trades were executed at or near 88.00, with other trades executing between 86.00 and 90.00 during the rest of the day.

The following trading day, December 18, 2020, saw 32 customer buy trades, with most trades executing between 86.00 to 88.00. Fortunately, for

Bondsavvy subscribers who bought this bond, its price continued increasing later in December and into January. On January 15, 2021, the bond

was trading around 95.00. Therefore, even investors who bought the bond at the higher price of 88.00, have still outperformed the market with

this investment. Their total return through January 15, 2021 was 8.87% compared to the 0.93% return for the iShares HYG ETF. Investors

buying in at 83.00 achieved a total return of 15.43% in less than one month.

With that said, our goal is to maximize total returns for all Bondsavvy subscribers. While we've been fortunate for this bond to continue to

increase in price, that may not always happen, so the buy-in price our subscribers can obtain is of high importance. While the number of trades

did increase markedly following our recommendation, we don't believe $1.3 million of customer buy activity should cause the price of a bond with approximately

$500 million outstanding to jump five points.

There are entire companies and businesses built around optimizing "market structure," which seeks to minimize the market impact large institutions

have when buying and selling securities in large sizes. While Bondsavvy can mitigate some of the impact our recommendations have on bond price

movements, we believe greater participation in our recommended CUSIPs from the market-making-dealer and retail-brokerage communities is key to solving

this problem.

Figure 9: Execution Prices of Customer Buy Trades for Case Study 3 Bond

Source: FINRA TRACE data

Bond Trading Volume Impact

Our Case Study 4 bond was issued by an oil & gas exploration company. It is Bond Recommendation 4 contained in this summary of our September 23, 2020 bond recommendations.

What's notable in Figure 10 is the level of sustained customer buy trades following the September 23, 2020 pick date. While the customer buy trades

peaked at 53 on the pick date, the number of trades remained above the levels prior to the pick date for approximately two weeks. As the Bondsavvy

subscriber base continues to grow, we expect the pick date volume to grow, as well as the volume for the trading days immediately following the pick date.

Based on historical volumes, we believe Bondsavvy subscribers accounted for approximately 93% of customer buy trades on the September 23, 2020 pick date.

The number of trades during the pick date plus the following two trading days increased 655% compared to the three trading days preceding the pick date.

Dollar volume increased slightly.

Figure 10: Corporate Bond Trading Volumes for Case Study 4 Bond

Source: FINRA TRACE data. $ volume in thousands.

Impact on Price of Recommended Bond

We were pleased with how the corporate bond market handled the increase in volume that resulted from this recommendation on September 23, 2020. As

shown in Figure 11, 51 customer buy trades ($1,051,000 in face value) were executed from 12:11pm EST, shortly after The Bondcast began, through 3:38pm, generally at or near the 91.60 pre-markup recommended

offer price.

While the price of this corporate bond began increasing in October 2020, Bondsavvy subscribers who acted within a week of our recommendation were able

to buy the bond at -- or, in many cases, below -- our recommended offer price. This is noteworthy, as, for the 21 trading days preceding our

September 23, 2020 pick date, there were seven trading days that recorded only one customer buy trade, and three trading days that had zero customer

buy trades. That the market was able to absorb a 655% increase in the number of trades with little impact to the price of the bond is encouraging

to us. While we do need to address the market impact displayed in Case Study 3, the fix should be achievable since the market appeared to work

well for this bond and, generally speaking, for the other bonds contained in our five case studies.

Figure 11: Bond Price Movements for Case Study 4 Bond

Source: FINRA TRACE data

CASE STUDY 5 - INVESTMENT-GRADE BOND RECOMMENDED SEPTEMBER 23, 2020

Bond Trading Volume Impact

The corporate bond we discuss in Case Study 5 is Bond Recommendation 3 from our September 23, 2020 edition of The Bondcast. Read this blog post for a preview of this set of corporate bond recommendations.

While the number of customer buy trades for the three trading days beginning on the pick date wasn't as high as it was for the other case studies, this

bond recommendation drove the highest increase in customer buy dollar volume, 1851%, with $16 million of incremental volume compared to the three trading

days preceding our September 23, 2020 pick date. Based on the number of trades executed during the three days preceding the pick date, we estimate

our subscribers accounted for approximately 91% of pick date customer buy trades for this bond. We continued to have a strong market share the following

trading day, with an estimated 75% of the customer buy trades resulting from BondSavvy's subscribers.

Figure 12: Corporate Bond Trading Volumes from Case Study 5 Bond

Source: FINRA TRACE data. $ volume in thousands.

Impact on Price of Recommended Bond

In Figure 13, the first customer buy trade on September 23, 2020 occurred at 12:08:21pm EST, about eight minutes into The Bondcast presentation.

The first 25 customer buy trades ($429,000 in face value) were all executed at prices less than or equal to 96.38. Please note that our recommended

offer price of 95.94 is before any brokerage markups. After the first 25 customer buy trades, there were 6 trades executed between 96.70 and 96.73.

Prices then fell slightly, with most customer buy trades executed below the 95.94 recommended offer price.

For this corporate bond recommendation, we were pleased to see that Bondsavvy subscribers were able to buy the recommended bond at, slightly above, or

slightly below our recommended offer price.

Figure 13: Bond Price Movements for Case Study 5 Bond

Source: FINRA TRACE data

Limiting Bondsavvy's Market Impact

In most cases, the corporate bond market has been able to handle the increased trading volumes driven by new Bondsavvy recommendations. This is encouraging, as, when we wrote this article, there were no market-making bond dealers who subscribed to Bondsavvy, meaning that the status quo market was able to absorb most of the extra volume with limited market impact.

That said, we saw the market impact in Case Study 3 as well as one other recently recommended Bondsavvy bond cause doubt among investors, which curtailed trading activity in these bonds. We believe it only takes one or two bad experiences to turn investors off from investing in individual corporate bonds, which is why we take the issue shown in Case Study 3 so seriously. In addition, Bondsavvy is still in its early innings. Very soon, we could see a day where the market needs to absorb significantly more Bondsavvy-subscriber orders in one corporate bond CUSIP. To put the power of corporate bonds into the hands of every investor, we need to plan for this day.

To help resolve the problem seen in Case Study 3 where our recommendation drove a material, immediate increase in the recommended bond's price, Bondsavvy has taken several steps to limit its market impact. These include but are not limited to:

- Hosting The Bondcast after the market closes to disperse corporate bond trades across the trading day and to provide all subscribers the ability to digest

our recommendations prior to executing corporate bond trades

- When possible, recommending multiple CUSIPs of the same issuer, a practice we began during the March 26, 2020 edition of The Bondcast

- Bondsavvy founder Steve Shaw not acting upon any Bondsavvy recommendation

until at least two trading days immediately following any new buy/sell recommendation

Over time, we will evaluate how these initiatives limit the market impact of our bond recommendations and, if needed, we will consider additional efforts

to ensure our subscribers can purchase and sell bonds at or near the recommended price.

Get Started

Watch Free Sample