Bond investors should be embracing rising interest rates rather than running scared. While rising interest rates may negatively impact certain corporate

bonds in the short term, over the long term, rising interest rates can be a good thing for bond investors, especially if they understand how the

corporate bond market works and invest accordingly.

While investors need to understand the risks of rising interest rates, excessive fearmongering does not serve investors well. Anyone can write an article

discussing investment risks and why investors should stay away. These myriad articles, however, don't equip investors to succeed. Rather, they simply

"urge caution" and encourage investors to stick with short-term bonds and be happy making 0.5-1.5%.

Individual Corporate Bonds: The Corporate Bond Investing Trifecta

It takes skill and expertise to empower investors to navigate ever-changing markets. BondSavvy has developed a strategy on how to profit from

rising interest rates, which is the focus of this fixed income blog post.

We believe BondSavvy subscribers who

follow our recommendations and strategy can achieve the trifecta of long-term investing goals: generate income, drive growth, and preserve capital.

Stocks, bond funds, and muni bonds may deliver up to two of these investment goals, but we believe investors who follow our recommendations and invest

in individual corporate bonds are positioned to achieve all three over the long

term.

Photo licensed from Canva

How To Profit from Rising Interest Rates

In Figure 1 below, we have laid out eight key considerations and strategies to show investors how to profit from rising interest rates. We discuss

each of the eight items in separate sections in this fixed income blog post.

Please keep in mind that this is not individualized advice and does not pertain to your specific situation. In addition, we modify our investment strategy

as market conditions change and new opportunities arise. Subscribe to our investment service to see all of our current corporate bond recommendations and be the first to know our new bond recommendations and corporate bond market insights.

Figure 1: Considerations and Strategies on How To Profit from Rising Interest Rates

|

1. Not all bonds in the diverse $50 trillion US bond market are sensitive to rising interest rates.

|

|

2. Over the long term, higher interest rates can be good thing for bond investors.

|

|

3. US Treasury yields are volatile and don't move in a straight line up or down. Trough-to-peak periods have lasted between 5 to 28

months since 2012.

|

|

4. Own individual bonds rather than bond funds so you can take advantage of buying and selling opportunities not available to bond

fund investors.

|

|

5. Consider a significant allocation to BondSavvy recommendations that have bond ratings below Baa3 / BBB-, as these high yield corporate bonds are generally not sensitive to rising interest rates.

|

|

6. Buy long-dated investment grade corporate bonds when their prices fall significantly (some have recently fallen 20%).

|

|

7. If certain bonds fall in price after an initial investment, buy more at a better price assuming the issuing company's creditworthiness

remains intact.

|

|

8. Invest over the course of the year rather than going 'all-in' at a specific point.

|

| |

|

SECTION 1

Not All Bonds in the Diverse $50 Trillion US Bond Market Are Sensitive to Rising Interest Rates

The bond market is massive and multifaceted. Many investors, however, make the mistake of lumping all bonds together. They often don't

appreciate that there are different segments of the bond market, and each segment has its own characteristics and behavior. For example,

we will be discussing how investment grade corporate bonds are sensitive to rising US Treasury yields and high yield corporate bonds are not.

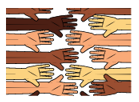

As shown in Figure 2, the $50 trillion US fixed income market is made up of six segments, with the $21 trillion US Treasury market being the largest.

Corporate debt, $10.6 trillion, is the third-largest segment and 2.7x larger than the $3.9 trillion municipal bond market.

The differences among -- and even within -- these bond market segments cause certain bonds to be heavily impacted by rising interest rates while others

are not.

Figure 2: Size of US Fixed Income Market by Segment as of 12/31/20 ($ in trillions)*

*Source: SIFMA. Figures based on face value outstanding.

The six primary segments of the US fixed income market are based on the type of entity that issues debt securities. US Treasurys are issued by

the US government; corporate debt is issued by companies; and muni bonds are issued by cities, states, authorities, colleges, and other similar

entities.

One bond in one bond market segment can be worlds away from a bond in another. For example, a $5 billion US Treasury bond with a maturity date

in 30 years is very different from a $250 million, 5-year, B-rated corporate bond issued by a midsize manufacturing company. These bonds

have different sets of investors, default risk, and level of trading activity (or "liquidity").

How Are Interest Rates Different from Corporate Bond Yields?

To understand how to profit from rising interest rates, it's important for investors to be clear on the terms that impact a bond's return.

The term "interest rates" is overused, and many investors use this term interchangeably with Treasury yields and corporate bond yields even though

they are very different.

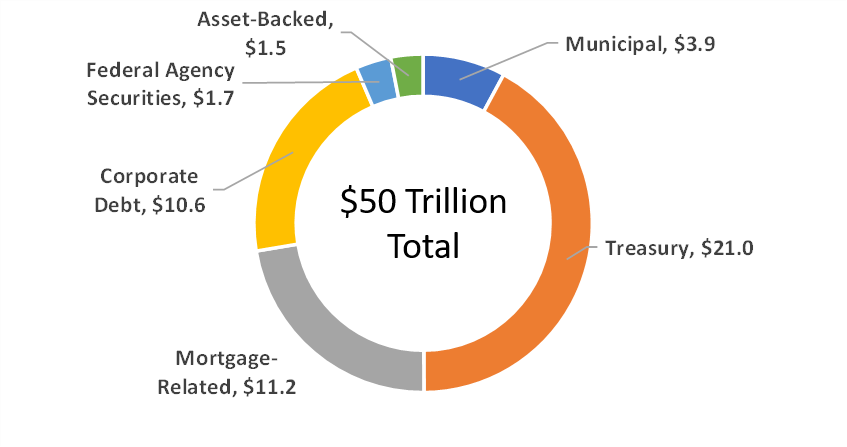

An easy way to think about the difference between interest rates and bond yields is the frequency these numbers change. As shown in Figure 3,

an interest rate, such as a coupon of a bond, is typically set for the life of the bond. In other cases, the rate can change periodically

in the case of a floating-rate note, an adjustable-rate mortgage, or the fed funds rate.

The coupon rate of a fixed rate corporate bond will be set when the bond is issued. If that coupon was 5.00% when the bond was issued, it will be 5.00%

when the bond matures.

Regardless of whether an interest rate is fixed or adjusts, it will be memorialized in writing somewhere, whether it be in a bond prospectus, a mortgage

note, or, in the case of the fed funds rate, the minutes of the Federal Open Market Committee (FOMC).

The current yields and yields to maturity of bonds, however, are very dynamic and can change hundreds of times within the same trading day. As

these yields change, interest rates of newly issued bonds move to reflect the yields available on similar, previously issued bonds.

Figure 3: Interest Rates vs. Bond Yields

* For retail investors, Treasury and corporate bonds are typically quoted as a percentage of their face value. Therefore, a bond quoted at 90.00 is worth 90% of its face value, or $900.

Drivers of Changes in Bond Prices

Since the US bond market is so large and diverse, investors can tailor their portfolios to their investment objectives and outlook with a variety

of bond investments. Since media coverage of the bond market is typically limited to the 10-year US Treasury yield, it's important for investors

to understand what drives bond prices in other segments of the US bond market.

As we will discuss later in this fixed income blog post, high yield corporate bonds are bonds that are generally not sensitive to changes in interest

rates. It's why the statement "when interest rates rise, bond prices fall" oversimplifies how bonds work and misleads investors. The

more accurate statement is "as the yield on a specific bond increases, the price on that specific bond decreases."

Figure 4 shows the different factors impacting the prices of US Treasury bonds and high yield corporate bonds:

Figure 4: Key Price Drivers of US Treasury Bonds vs. High Yield Corporate Bonds

| US Treasury Bond |

High Yield Corporate Bond |

1. US and global economic growth expectations

|

1. Issuer's recent and expected financial performance

|

2. Level of new Treasury issuance and government spending

|

2. High yield corporate bond fund inflows and outflows

|

3. Inflation expectations

|

3. Changes in bond ratings

|

4. Level of any Fed bond buying programs

|

4. Level of trading activity and bid-ask quotes

|

5. US Treasury yields vs. other sovereign debt bond yields

|

5. Sentiments regarding future economic growth

|

6. Financial, geopolitical, and other crises that could drive a 'flight to quality'

|

6. Industry-specific factors, such as commodity prices

|

| 7. Investment grade bond fund inflows and outflows |

|

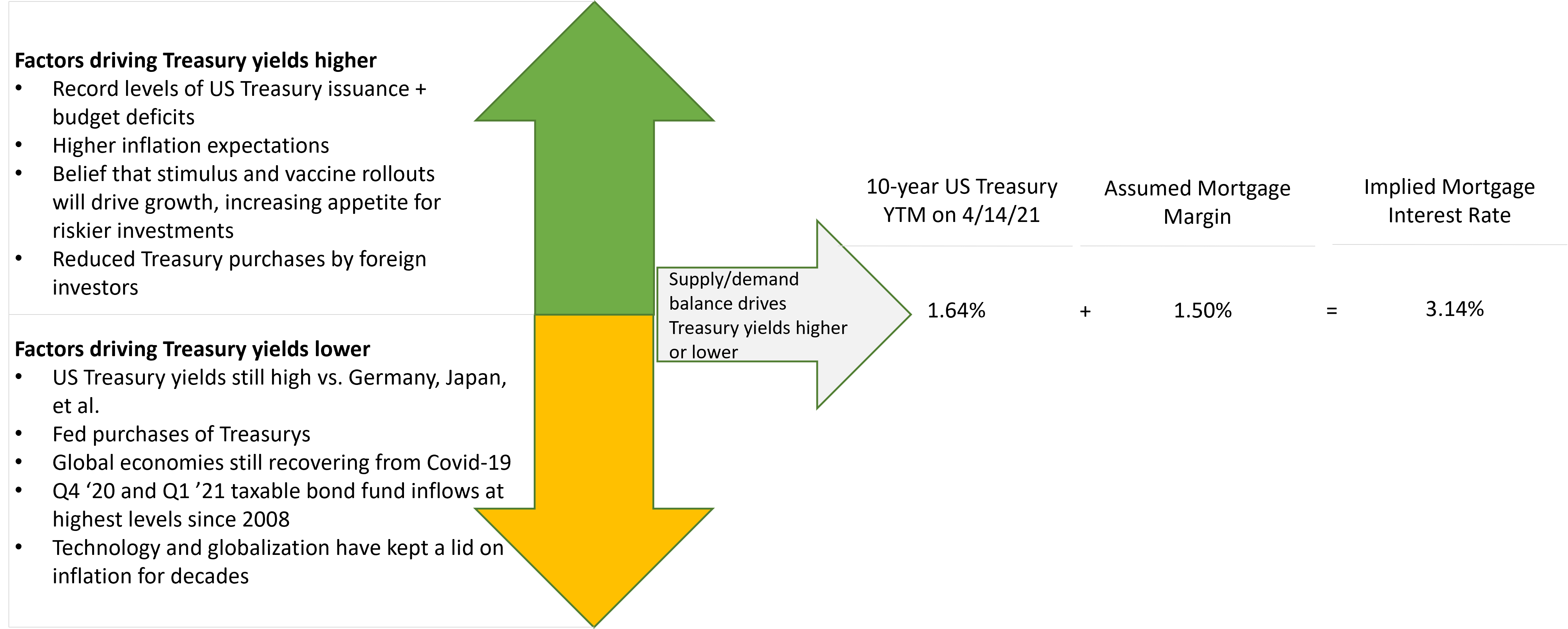

The Relationship Between Rising US Treasury Yields and Interest Rates

You'll notice that nowhere in the above table does it say "interest rates" as the key driver. The reason is that, in the case of Treasury

bonds, their yields to maturity are driven by supply and demand that are impacted by the above factors.

These yields to maturity are known as "Treasury yields," which are often used as the reference points to set certain interest rates such as the

interest rate charged on a home mortgage. For example, many adjustable rate mortgages are based on a spread to the 10-year Treasury yield,

as we show in Figure 5. As Treasury yields increase and decrease based on the factors on the left of the graphic, the mortgage's reference

Treasury yield also moves until it gets locked. The mortgage company will then add a spread to the reference Treasury yield, which we show

as 1.50% in this example.

Figure 5: How US Treasury Yields Drive Interest Rates

In short, it's the supply and demand for US Treasury bonds that determine the yields to maturity for these bonds, which, in turn, drive interest rates

charged for loans and other forms of consumer and commercial credit.

How Can Rising US Treasury Yields Impact Corporate Bond Prices?

US Treasury yields not only impact mortgage and other consumer loans, but they also impact the rates at which companies borrow and the movements

of certain corporate bond prices. As corporate bonds are deemed to have a greater default risk than US Treasury bonds, their YTMs are higher

than a Treasury bill, note, or bond with a similar maturity. The difference between a corporate bond's YTM and the YTM of a Treasury bond

with a similar maturity date is known as the credit spread.

This spread, also known as a Treasury spread, represents the extra yield corporate bond investors receive to compensate them for taking a perceived

greater level of credit risk than that of a US Treasury bond.

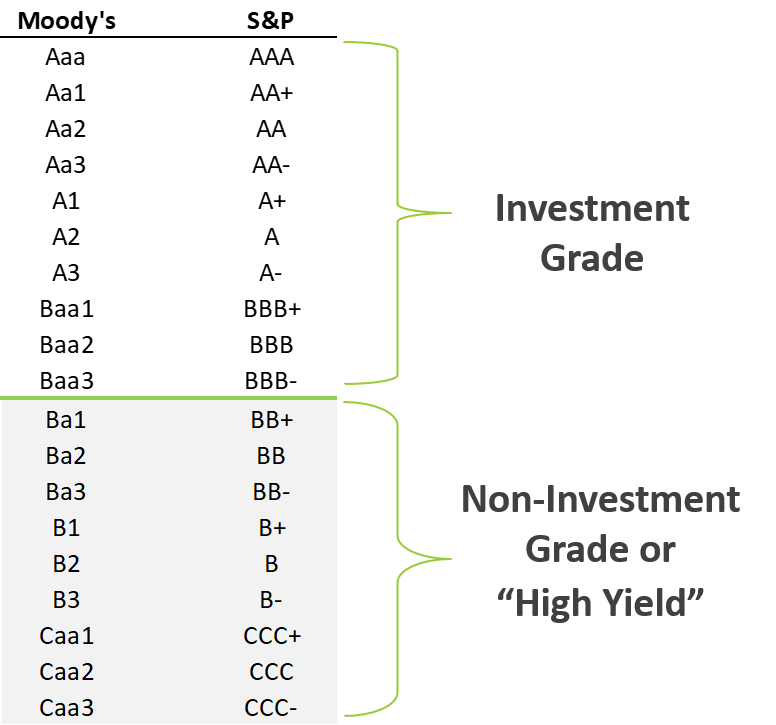

As we discuss further below, the bond rating of a corporate

bond has a big impact on what happens to corporate bond prices when Treasury yields rise. Bond rating agencies, such as S&P and Moody's,

assign corporate bond ratings to assess the likelihood of a corporate bond default. As shown in Figure 6, bond ratings work similar to school

grades, with A being better than B, and B being better than C. The larger quantity of letters within a specific letter category means the

rating agencies assign a lower risk of default. For example, for S&P ratings, S&P believes a bond rated BBB has a lower risk of default

than one rated B.

Corporate bonds with ratings of at least Baa3 / BBB- are deemed to be investment grade corporate bonds. Bonds rated below this are called high

yield corporate bonds or sub-investment-grade bonds. As we discuss below, bonds rated investment grade can often be highly sensitive to changes

in Treasury yields whereas high yield corporate bonds typically have little to no interest rate risk. Corporate bonds that are sensitive

to changes in Treasury yields are deemed to have high interest rate risk, while corporate bonds that are not sensitive to changes in Treasury

yields are deemed to have low interest rate risk.

Figure 6: Corporate Bond Ratings Scale

Impact of rising Treasury yields on investment grade corporate bonds

While bond ratings methodologies are

flawed and have many limitations, they do impact how corporate bonds trade on institutional bond trading desks and, as a result, the interest rate

risk of corporate bonds. On trading desks, investment grade corporate bonds are quoted as a credit spread to the yield to maturity (YTM) of a Treasury note or bond with a similar maturity, which is known

as the "benchmark Treasury." As credit spreads and underlying Treasury yields change throughout the trading day, investment grade corporate

bond YTMs also change, which then causes bond prices to move.

Figure 7 illustrates how closely the performance of investment grade corporate bonds can be tied to the benchmark US Treasury bond. On September

26, 2017, we recommended the Verizon 3.850% 11/1/42 (CUSIP 92343VBG8) bond to BondSavvy subscribers.

The benchmark Treasury bond, in this case, is the US Treasury 2.75% 11/15/42 (CUSIP 912810QY7). If we zoomed in on specific parts of the

chart, there would be times where the two bonds did not move in lockstep. That said, the overall pricing trends are very similar to each

other.

Figure 7: Price Performance of Verizon '42 Bond vs. Benchmark Treasury

September 26, 2017-May 12, 2021

Source: FINRA market data

Like many long-dated investment grade corporate bonds, this Verizon bond plummeted during the March 2020 Covid-induced market panic, where there were

many bond bargains to be had. Even certain bonds issued by Apple fell 40 points, before quickly recovering following the Fed cutting the

fed funds rate to zero, buying trillions in bonds, and announcing a corporate bond-buying program.

After initially recommending the Verizon '42 bond at a price of 89.62 on September 26, 2017, we recommended our investment newsletter subscribers sell the bond at 106.43 on September 9, 2019. This generated a 27.01% investment return compared to a 12.53% return for the iShares LQD investment grade corporate bond ETF.

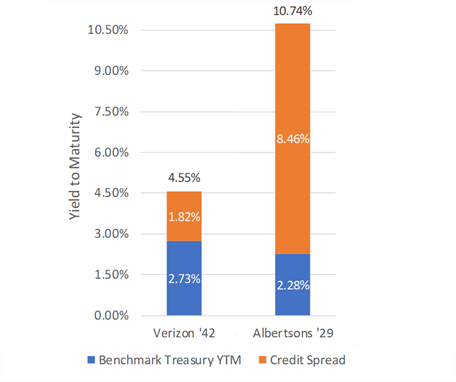

Breakdown of a Corporate Bond's Yield to Maturity

To better understand what drives corporate bond prices, it's helpful to know the portion of a corporate bond's YTM that is the benchmark Treasury

YTM vs. the bond's credit spread. If a corporate bond's

YTM is heavily weighted toward either component, the bondholder will know the larger potential source of gains and/or losses.

Figure 8 shows the YTMs of two corporate bond investment recommendations BondSavvy made in its first set of investment recommendations on September

26, 2017: the Verizon '42 bond, which we discussed above and was rated investment grade, and Albertsons Inc. 7.45% 8/1/29 (CUSIP 013104AF1), which

was rated below investment grade.

Figure 8: Building Blocks of a Corporate Bond's YTM

Source: Fidelity.com. YTMs and credit spreads from September 26, 2017, the date of the recommendations.

In the case of the Verizon bond, on the recommendation date, the benchmark Treasury had a YTM of 2.73%. The US Treasury market is the most actively

traded US fixed income market, and Treasury bond YTMs can move quickly throughout the day. If the credit spread of the Verizon bond doesn't

change, changes to the Verizon bond's YTM will move up and down in sync with the benchmark US Treasury bond.

Over time, both the benchmark Treasury YTM and the Verizon bond's credit spread will impact the price of this bond. Since, on the recommendation

date, 60% of the Verizon bond's YTM was the benchmark Treasury YTM, future movements in the Verizon bond's YTM could have been potentially influenced

slightly more by the Treasury market than the credit spread.

Please note that, while investment grade corporate bonds trade based on their credit spread on professional trading desks, investors who buy bonds online will always see bonds quoted on a 'dollar price' basis, as discussed

below.

Impact of rising Treasury yields on high yield corporate bonds

High yield corporate bonds, on the other hand, do not trade in relation to the comparable US Treasury bond or note. We will discuss why this

is shortly; however, the best way to illustrate this is through an example.

Figure 9 compares the price performance of the L Brands 6.875% 11/1/35 (CUSIP 501797AL8) corporate bond, a previous BondSavvy recommendation, to its

benchmark US Treasury 4.50% 2/15/36 (CUSIP 912810FT0). As Treasury yields have risen over the last several months, the price of the US Treasury

'36 bond has fallen from 156.34 on August 6, 2020 to 131.84 on March 19, 2021, a 15.7% decline. Meanwhile, from May 12, 2020 to May 12, 2021,

the L Brands '35 bond price has increased over 81%.

Figure 9: Price Performance of L Brands 6.875% '35 Bond vs. Benchmark Treasury

May 12, 2020-May 12, 2021

Source: FINRA market data

L Brands has been delivering record financial performance, driven by continued strong performance of its Bath & Body Works business and an in-process

turnaround of Victoria's Secret. It's this financial performance that led the bond higher, since, as a high yield corporate bond, its bond

price is not influenced by changing US Treasury yields as was the case with the Verizon bond.

Why High Yield Corporate Bonds Are Generally Less Sensitive to Rising Interest Rates

You'll remember from our Verizon bond example how, on professional trading desks, investment grade corporate bonds trade as a spread to their benchmark

US Treasury bond. As a result, as US Treasury YTMs move during the trading day, there is often a direct impact on investment grade corporate

bond prices.

High yield corporate bonds are a horse of a different color.

On professional trading desks, high yield bonds are quoted as a 'dollar price,' which reflects a bond's value as a percentage of its face value.

For example, a bond with a dollar price of 98.00 has a value of $980, or 98.00% of the bond's $1,000 face value.

This is a trading protocol that has a significant – and largely unknown – impact on how corporate bonds trade. Since high yield corporate bonds are

quoted on a dollar price basis, their price movements are unlinked from movements in US Treasury yields.

Keeping trading protocols aside, as shown above in Figure 8, of the Albertsons' bond's 10.74% YTM, 8.46% is the credit spread with the remaining 2.28% ascribed to the benchmark Treasury YTM. Clearly, the greater component

of the Albertsons' bond's YTM is the credit spread, which is why high yield bonds are deemed to be 'credit investments,' largely tied to the improving

or worsening credit profile of the bond issuer.

As noted earlier in Figure 4, high yield corporate bond prices are impacted by the issuing company's financial performance, bond fund flows, overall

economic conditions, and other factors. Many bond investors live in fear of inflation, but inflation can be a tailwind for many high yield

bonds, especially those of issuers that benefit from higher commodity prices, such as oil & gas producers.

Key takeaway

We have discussed how bond rating methodologies often reward large undeserving companies with high ratings and penalize smaller companies with low ratings. The beauty of many high yield

corporate bonds is that they can have superior financials to many investment-grade-rated bond issuers; however, since high yield bonds do not trade

relative to US Treasurys, many high yield bonds have low credit risk and low interest rate risk.

SECTION 2

OVER THE LONG TERM, INVESTORS CAN PROFIT FROM HIGHER INTEREST RATES

As discussed above, high yield corporate bonds are generally not sensitive to changes in Treasury yields. High yield corporate bonds, generally

speaking, perform better when the overall economic climate is improving, as this typically drives lower bond default rates. Such periods

are often associated with rising Treasury yields and rising interest rates. Further, as natural resources companies make up a significant

portion of high yield corporate bond issuers, rising commodity prices often associated with economic expansions can be a tailwind for many high

yield corporate bond issuers.

There are two other reasons why rising interest rates can benefit bond investors, as shown in Figure 10:

Figure 10: How Long-Term Investors Can Profit from Rising Interest Rates

|

Reason 1: As discussed in Section 1, many corporate bonds are not sensitive to changes in interest rates and

have continued to perform well in spite of rising interest rates. |

|

Reason 2: There are many more bond buying opportunities than there were in mid-2020, with bonds of some of the world's

best companies now trading in the 80s and low 90s.

|

|

Reason 3: Rising interest rates can drive higher bond coupons and yields on many future corporate bond investments.

|

| |

|

Reason 1 Rising Interests Rates Can Be Make Bond Investing More Profitable:

Please see above discussion in Section 1 regarding which bonds are not sensitive to higher interest rates.

Reason 2:

More Profitable Investment Grade Corporate Bond Buying Opportunities with Higher Interest Rates

As the Treasury market was rallying, with 30-year US Treasury yields falling as low as 1.19% on August 4, 2020, bargains for investment grade corporate

bonds were limited. Some long-dated investment grade corporate bonds issued when corporate bond coupons were much higher traded as high as

170.00, pricing levels that can only be achieved with long-dated bonds.

In late 2020, 30-year US Treasury yields began increasing, a trend that continued into 2021. As Treasury yields reached a high of 2.45% on March

19, 2021, many corporate bond prices fell, with long-dated bonds of some of the world's best companies dropping 20%. Many of these bonds

fell into the 80s, with some into the high 70s.

The essence of our investment strategy is buying corporate

bonds at compelling values (below par whenever possible), monitoring the financial performance of the issuers of our recommended bonds, and, as

upside wanes, selling bonds before maturity to protect capital appreciation and to maximize our investment returns. Some of our most successful investments have been when we recommended

subscribers purchase investment grade corporate bonds at a discount, including some bonds trading in the 80s.

Reason 3:

Higher Interest Rates Can Drive Higher Coupons, Bond Yields, and Capital Growth on Future Investments

While rising interest rates can cause some short-term pain for certain bond investments, investors with a longer-term time horizon can benefit

from the tailwinds higher interest rates can create.

It's generally easier for investors to increase their corporate bond returns when the 30-year Treasury yields 3.50% vs. 1.50%. First, newly issued

corporate bonds will have generally higher coupons, which provide investors a higher level of interest income. Assuming an improving economy,

investors should enjoy this higher income with less corporate bond default risk.

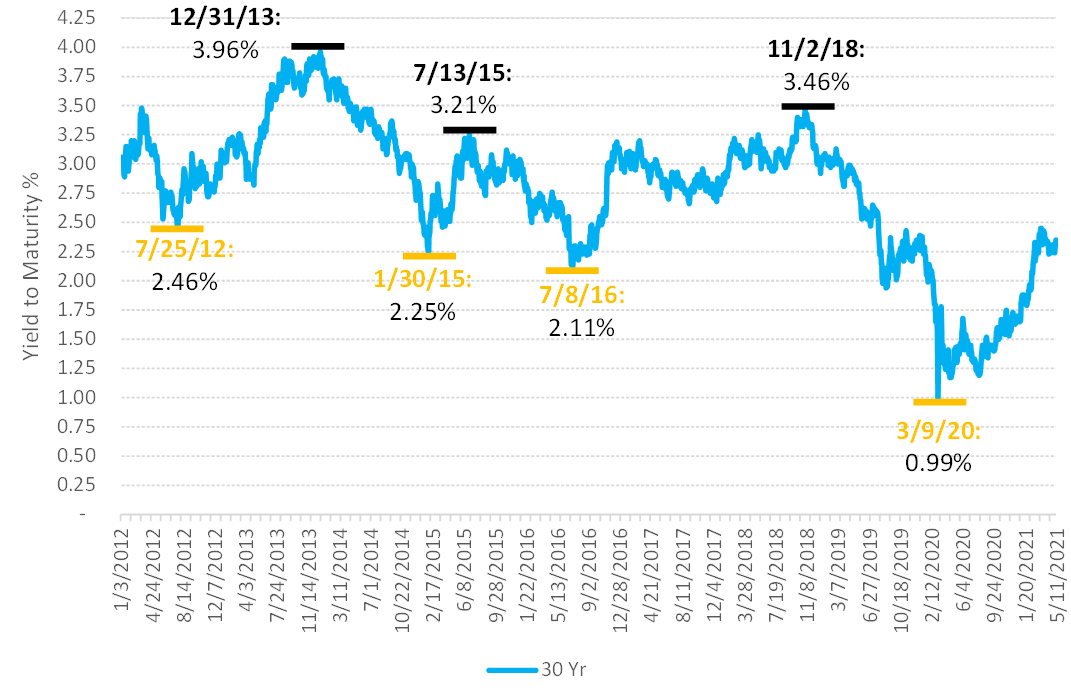

Second, investment grade corporate bond investors, in particular, have potentially higher upside on future bond purchases. As shown below in

Figure 11, the US Treasury market is volatile. Even if we assumed the longer-term trend is toward rising interest rates, there will likely

be periods when there are flights to quality, which drive US Treasury yields lower and, keeping credit spreads constant, can result in higher investment grade corporate bond prices. Compounding this

factor, if future Treasury yields are higher than they are today, there would be more room for Treasury yields to fall, which could boost investment

grade corporate bonds.

SECTION 3

INVESTORS CAN PROFIT FROM TREASURY YIELD VOLATILITY DRIVEN BY HIGHER INTEREST RATES

Many investors have heard the phrase "a rising rate environment." This phrase not only creates much angst among investors but also oversimplifies

movements in US Treasury yields. No less than Warren Buffett, at the 2018 Berkshire Hathaway annual meeting, said "we think long-term bonds

are a terrible investment." This caused many investors, including Mr. Buffett, to miss out on the November 8, 2018 to August 6, 2020 US Treasury

rally, where 30-year Treasury yields fell from 3.43% to 1.20%, resulting in strong returns for long-term investment grade corporate bonds.

We don't try to predict where Treasury yields will be in 3 months, or 6 months, or 18 months. As shown earlier in Figure 5, there are many factors

that drive Treasury yields higher and lower, so making time-specific predictions is extraordinarily difficult.

While we may not know where US Treasury yields will be in a number of months, we do feel confident that, at some point over the next 2-3 years, long-term

Treasury yields will either be at current levels or lower. Lower Treasury yields -- assuming no change in credit spreads -- would drive investment

grade corporate bond YTMs lower and their bond prices higher.

Figure 11 shows the volatility of 30-year US Treasury yields from 2012 until May 11, 2021. While there was an overall trend of long-term US Treasury

yields falling from December 2013 until March 2020, there were periods where long-term Treasury yields increased only to fall afterward.

Volatility and US Treasury yields go hand in hand.

Figure 11: Historical 30-year US Treasury Yields -- 2012-YTD 2021

Source: US Treasury data

In Figure 11, the horizontal orange bars represent Treasury yield troughs while the black horizontal bars represent Treasury yield peaks. We

summarize the time between troughs and peaks -- and the magnitude of each change in 30-year Treasury yields -- in Figure 12. The key takeaway

from Figure 12 is that rising Treasury yields and falling Treasury yields don't go on forever. Since 2012, the shortest trough-to-peak period

was 5.5 months while the longest was 28.2 months. The last trough began March 9, 2020, which is why we believe that, at some point over the

next one to three years, Treasury yields will fall.

Figure 12: Timing and Magnitude of 30-Year Treasury Movements

| |

|

Start Date |

|

End Date |

|

# Months |

|

Change |

| Trough to Peak 1 |

|

7/25/12 |

|

12/31/13 |

|

17.5 |

|

+1.50% |

| Peak to Trough 1 |

|

12/31/13 |

|

1/30/15 |

|

13.2 |

|

-1.71% |

| Trough to Peak 2 |

|

1/30/15 |

|

7/13/15 |

|

5.5 |

|

+0.96% |

| Peak to Trough 2 |

|

7/13/15 |

|

7/8/16 |

|

12.0 |

|

-1.10% |

| Trough to Peak 3 |

|

7/8/16 |

|

11/2/18 |

|

28.2 |

|

+1.35% |

| Peak to Trough 3 |

|

11/2/18 |

|

3/9/20 |

|

16.4 |

|

-2.47% |

Source: US Treasury data and BondSavvy calculations.

This illustrates another big advantage between owning individual bonds vs. bond funds. Individual bondholders decide when to sell their bonds, as they

don't have the forced buying and selling that bond funds have. As a result, investors in individual corporate bonds can be patient.

If Treasury yields rise, and, if certain corporate bond prices fall, we can buy more of previously recommended bonds. Later, if and when

US Treasurys rally, depending on the magnitude of the rally, we can sell our bonds to maximize capital gains and total returns.

SECTION 4

OWN INDIVIDUAL BONDS RATHER THAN BOND FUNDS TO TAKE ADVANTAGE OF BUYING AND SELLING OPPORTUNITIES

Most investors underestimate the investment returns possible in

the US corporate bond market. Many believe bonds are just for clipping coupons and don't appreciate the strong capital gains and total returns

individual corporate bonds can achieve.

Many have arrived at this conclusion as the result of investing in the mega bond funds. These investors have grown accustomed to 2-3% annual

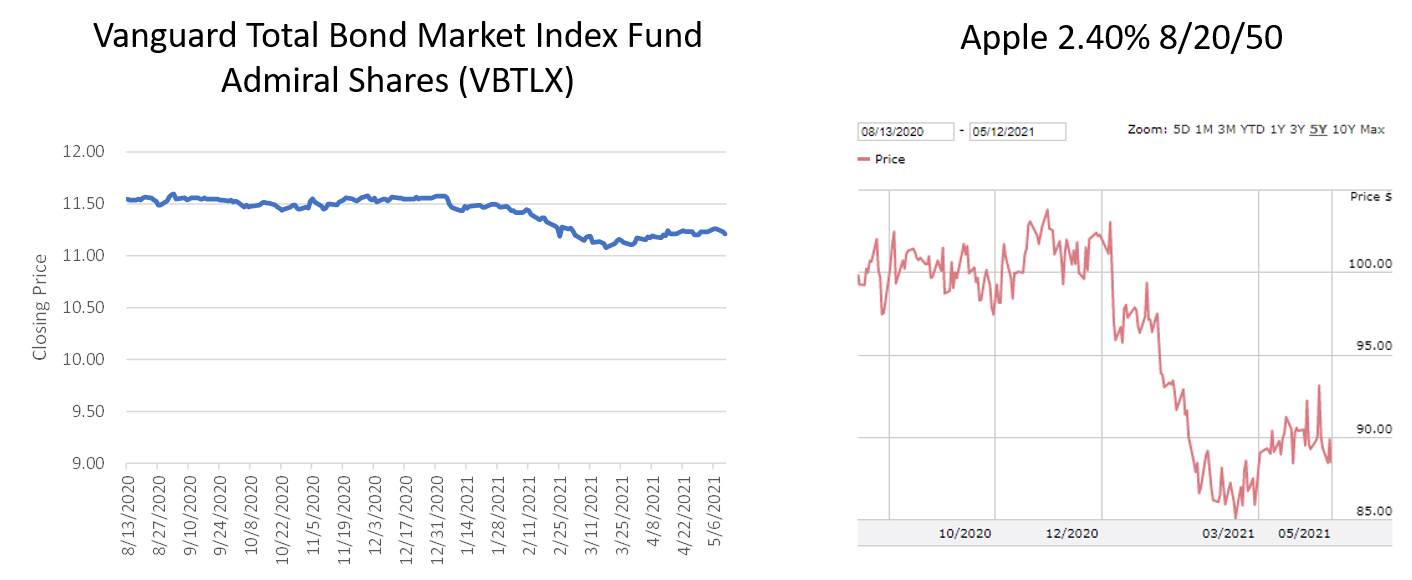

returns and limited, if any, capital appreciation. The reason for this is that the mega bond funds, such as the $300 billion Vanguard Total

Bond Market Index Fund (Ticker: VBTLX)

and the $87 billion iShares Core U.S. Aggregate Bond ETF (Ticker: AGG) own staggering amounts of bonds that dilute their returns. VBTLX owned

10,118 bonds as of March 31, 2021 while iShares AGG owned 9,588 as of May 11, 2021.

Selective investors they are not.

There are simply not 10,000 bonds worth owning. We know this from our own experience making corporate bond investment recommendations.

Each quarter, we typically recommend 5-6 new corporate bonds for BondSavvy subscribers.

Depending on the market environment, it can be difficult finding compelling investment opportunities even for a small number of bonds. When

bond funds employ the 'own-everything' approach, they limit their ability to achieve strong returns for their investors.

Profit from US Treasury Yield Volatility

A key difference between owning individual bonds vs. bond funds is

the level of pricing volatility and the ability to buy low and sell high to maximize capital appreciation and total returns. In Figure 13,

we show the price performance of VBTLX vs. the Apple 2.40% 8/20/50 bond (CUSIP 037833DZ0), which was issued August 13, 2020.

Figure 13: Price Performance of VBTLX vs. Apple 2.40% 8/20/50 Bond

Sources: Nasdaq market data for VBTLX and FINRA market data for the Apple '50 bond.

While VBTLX is an investment grade bond fund with many bonds sensitive to rising interest rates, it owns many short-term bonds that are not sensitive

to interest rates. As Treasury yields rose in Q4 2020 and Q1 2021, the price of VBTLX fell from 11.67 to 11.08, a 5% decline. The Apple

'50 bond, on the other hand, fell from 103.77 on November 30, 2020 to 85.14 on March 18, 2021, an 18% decline.

Apple was still the same great company on March 18, 2021 as it was on November 30, 2020, when the bond was priced at 103.77. The Apple bond

fell because it is a long-dated, investment grade corporate bond, which is sensitive to rising Treasury yields.

Some investors may prefer the lack of volatility offered by VBTLX, and that's okay. That said, these investors are taking capital appreciation

off the table. Our investment strategy is to

maximize capital appreciation and total returns. While we do not know if Treasurys will rally in the next three months or even the next year,

we believe, at some point, Treasurys will rally and/or credit spreads will shrink. We then expect this Apple bond -- and other high-quality

bonds recently priced in the mid- to low-80s -- to increase in value and trade at or above par.

These types of capital appreciation opportunities are only available to investors in individual corporate bonds -- not mega bond funds such as VBTLX.

Of course, the greater opportunity for capital appreciation does come with the near-term risk of paper losses should Treasury yields and/or credit

spreads increase. Investors must carefully weigh this tradeoff.

SECTION 5

CONSIDER A GREATER ALLOCATION TO HIGH YIELD CORPORATE BONDS

We have never referred to bonds with bond ratings below Baa3 / BBB-

as "junk bonds," and we never will. Many high yield bonds, due to flawed bond ratings methodologies, have financials superior to certain investment-grade-rated corporate

bonds. Unfortunately, investors have been led to believe that all high yield corporate bonds are extremely risky, which is not the

case. A similar situation has unfolded among BBB-rated bonds, where many now assume that a large portion of BBB-rated corporate bonds are

on the verge of default.

As we discussed above, high yield corporate bonds are typically not sensitive to changes in Treasury yields. Therefore, in periods of rising

Treasury yields, we advocate allocating a significant portion of a bond portfolio to high yield corporate bonds. BondSavvy does not provide

individualized advice and does not prescribe asset allocation figures; however, of the 31 corporate bonds BondSavvy had recommended as a buy or

hold on May 13, 2021, 21 were high yield corporate bonds vs. 10 investment grade corporate bonds.

Our allocation between high yield corporate bonds and investment grade corporate bonds changes over time. Of the 45 bond recommendations we had

exited prior to April 30, 2021, 20 were investment grade corporate bonds while 25 were high yield corporate bonds, as shown in our corporate bond returns page.

High yield bond risks

At the time of this writing, we have two significant caveats related to high yield corporate bond investing. First, while many investment

grade corporate bond prices have fallen due to rising interest rates, many high yield bonds have continued to perform well. Some of these

bonds now trade well above par, so it has recently been difficult to find compelling values in high yield bonds.

The composition of recommendations noted above has been put together over four years of BondSavvy corporate bond recommendations. As a result,

many bonds that currently trade between 115-120 we were fortunate to recommend when they were trading below par. We recommend investors looking

to increase their exposure to high yield bonds do so over time, as we further discuss in Section 8.

Second, please be aware of call schedules. When companies issue new high yield corporate bonds, they typically come with call schedules,

whereby the issuer can redeem the bond prior to maturity at a set price. This provision is advantageous to the issuer but can significantly

impair the upside potential of a bond.

For example, suppose a high yield corporate bond due in five years pays a 5% coupon. Assume the bond currently trades at par but is callable

at 102 in two years. Due to the call provision, the bond will not trade materially above 102, as an investor would not want to buy the bond

at, say, 110, only to have it called at 102 in a short period of time.

In this case, the bond's "yield to call" would be materially less than the bond's YTM, which discourages new investors to buy callable bonds at

prices materially above the next call price. To safeguard against making this mistake, brokerages typically show a bond's "yield to worst,"

which is the lower of the bond's YTM and the "worst" yield to call among all of the bond's call dates and call prices.

SECTION 6

BUY LONG-DATED INVESTMENT GRADE CORPORATE BONDS WHEN THEIR PRICES FALL SIGNIFICANTLY

The follow-the-herd strategy in periods of rising interest rates is 'to stay short,' or to buy bonds with near-term maturities to limit paper losses

due to rising Treasury yields. For investors satisfied with 1-2% annual returns and little hope of capital appreciation, this is a fine strategy.

It's important to keep in mind, however, that investors focused on interest rate risk can still buy longer-dated high yield corporate bonds and

not fear an investing apocalypse should 10-year Treasury yields tick up half a percentage point.

Our investment strategy seeks to maximize total returns

over the life of each recommendation, so we do not believe in limiting our bond recommendations to short-term corporate bonds. At the first

scent of rising interest rates, many fixed income investors sell any bond they own that has a maturity greater than five years, afraid of any paper

loss. When legions of investors are scared to own a volatile -- yet very safe -- investment such as long-term investment grade corporate

bonds, it's a good time to be a buyer.

Often times, long-term investment grade corporate bonds are the Rodney Dangerfield of investing, getting no respect.

Imaged licensed from Alamy.

Some of our most successful investments have been when we recommended purchasing long-dated investment grade corporate bonds at compelling values,

often in the 80s and 90s. Examples of high-returning long-dated investment grade corporate bonds we have recommended and exited include:

Verizon 3.85% '42, BNSF 3.90% '46, Apple 3.45% '45, Tiffany 4.90% '44,

and CSX 3.80% '46. You can view details for these bonds as well as the performance of our current recommendations on our corporate bond returns webpage.

Bonds issued by the world's greatest companies have fallen in price

As Treasury yields have recently spiked, many long-dated bonds of some of the world's best companies have fallen 20%. We are value investors

when it comes to bonds, and buying high-quality bonds in the 80s and 90s can drive high returns, as, at some point, we expect the value of these

bonds to recover. Since investment-grade corporate bonds are typically not subject to call schedules like high yield bonds are, they often

have greater upside than high yield bonds whose call prices can create price ceilings at or near the next-scheduled call price. While rare,

investment grade corporate bonds can trade up to 150% of par value and, in very limited cases, up to 180% or 190%.

Own both high yield and investment grade corporate bonds to profit from rising interest rates over the long term

In periods of rising interest rates, some may wonder why we would want to own any investment grade corporate bonds given their often high

interest rate risk.

We believe it's important for a corporate bond portfolio to have both investment grade and high yield corporate bonds. As noted earlier, the

prices of investment grade and high yield corporate bonds move due to different factors, and we do not want all of the investments in a bond portfolio

to move in lockstep.

In addition, during the writing of this fixed income blog post, most high yield corporate bonds were fully priced and often trading well above par

value. In May 2021, the lion's share of corporate bonds trading below par value were long-dated investment grade corporate bonds.

While we are not advocates of the overdiversification of bond funds, we do believe in some level of diversification. Across our corporate bond recommendations, we include bonds of varying credit quality, maturity dates,

and industry sectors. We believe a portfolio with this type of diversification positions subscribers to mitigate risk and maximize

investment returns.

SECTION 7

IF PRICES FALL AFTER INITIAL INVESTMENT, BUY ADDITIONAL AMOUNTS OF THE SAME BOND ASSUMING INVESTMENT THESIS REMAINS

If we recommend to buy a corporate bond at 95.00, that bond could fall in price. It's no reason to panic. If that bond falls to, let's

say 85.00, and the company continues to report strong financials, we often recommend subscribers buy more of that same bond at the lower price.

While we would have a paper loss on the initial purchase of the bond at 95.00, at some point, we believe the bond will rally, and we will own some

of our investment at a very low price.

It's important for bond investors to distinguish between a short-term paper loss and a permanent capital loss. Granted, if we buy a bond and

long-term Treasury yields increase, it's likely the long-dated investment grade corporate bonds we recommend will fall in price. Just as

Warren Buffett buys stocks when they fall in price, we believe it's important to do the same with bonds.

Since we make recommendations after companies report quarterly earnings, there will be times when Treasury yields rise -- or fall -- immediately after

a new set of bond recommendations.

This is why we recommend subscribers, especially when purchasing long-dated investment grade corporate bonds when Treasury yields have been rising,

to invest in new bond recommendations over time. We discuss the importance of this in the next section.

SECTION 8

INVEST OVER TIME AND DO NOT GO 'ALL-IN' AT A SPECIFIC TIME

We believe investors should ignore most bond investing conventional wisdom. For example:

- We do not hold bonds to maturity.

- We believe bond ladders leave small

fortunes on the table and should be avoided.

- We believe a select portfolio of individual bonds can drive higher investment returns than much-hyped bond index funds.

- We do not limit our investments to short-term bonds during periods of rising interest rates.

- We embrace long-term corporate bonds, even during periods of rising Treasury yields.

- We see periods of rising interest rates as a long-term positive for bond investors.

BUT...

With all that said, we do subscribe to one general piece of investing conventional wisdom. This sage advice is to make investments regularly,

in reasonably sized increments, rather than attempting to time the market and invest a lot at a single time. This is why we present our

investment newsletter subscribers with new corporate bond recommendations each quarter and then regularly throughout the year. The corporate

bond market is always changing, with new opportunities arising over the course of the year.

We are reminded of the story of a new bond investor who built a bond ladder in February 2020. He was so excited to invest in bonds that he plopped

down $250,000 and built a bond ladder. This represented a significant portion of his portfolio.

As bond prices collapsed in the wake of Covid-19 during March 2020, he could not take advantage of the bond market bargains suddenly available.

In short, he tried to time the market, paid high prices for the bonds he purchased, and missed out on the Covid-induced bargains.

While this is the most basic part of our investment strategy, following it is key to making the other parts work. Not following this part of

the strategy would increase risk and limit your ability to capitalize on opportunities that arise.

Many years ago, BondSavvy's founder Steve Shaw, a PGA golf professional

when in college, took a golf trip to northern Ireland and Scotland. On one picture-perfect day, his playing partner said, "the weather

is great now, but just wait 15 minutes and it will probably be raining." The unpredictable nature of British Isles weather draws some parallels

to the ever-changing and volatile US bond market.

In the case of bond investing, pandemics, geopolitical events, volatile Treasury yields, and other factors take investors out of the driver's seat.

Sometimes, such as right after bonds hit bottom around March 19, 2020, there will be opportunities for extraordinary gains. We never know

when these opportunities will arise. Therefore, our approach must be flexible enough so we can capitalize on rare opportunities when they

occur and avoid significant mistakes if rain could start falling at a moment's notice.

WHY SUBSCRIBE TO BONDSAVVY

Given the importance of fixed income investing, investors can't sit on the sidelines whenever interest rates are rising. Investors need the corporate

bond investing trifecta -- generate income, drive growth, and preserve capital -- in their portfolios across a variety of market environments.

BondSavvy's corporate bond recommendations make this possible. Our recommendations and insights pinpoint where the opportunities are so our subscribers

can increase their corporate bond returns.

The mega bond funds invest indiscriminately so they can mirror an index. In these funds, size matters and little else. This own-everything

approach is the exact opposite of what bond investors should be doing in periods of rising interest rates.

A BondSavvy subscription provides you immediate access to our current corporate bond recommendations and all new bond picks and updates for as long

as you subscribe. Our exclusive bond recommendations give investors an edge in the ever-changing corporate bond market.

Click the orange "Get Started" button to learn about BondSavvy subscription options or the "Watch Free Sample" button to view a sample edition of The Bondcast,

our interactive subscriber webcast where we present new corporate bond investment recommendations.

Get Started

Watch Free Sample