With 1.75 points of Fed rate cuts since September 2024, 5% money market yields are a distant memory. Money market yields move in lockstep with the fed funds rate, and, between August 1, 2024 and January 21, 2026, the Vanguard VMFXX 7-day yield has fallen from 5.30% to 3.63%.

The December 2025 Fed dot plot projected an additional 0.50 points (50 "basis points") of Fed rate cuts through 2027. Should this happen, the Vanguard VMFXX yield would fall to approximately 3.13%.

The $381 billion Vanguard VMFXX fund worked well when the fed funds rate was over 5%, but there are now more compelling alternatives. These include individual corporate bonds, which enable investors to lock in income for longer time periods, to pay lower fees, and to benefit from capital appreciation opportunities.

This fixed income blog post discusses the eight reasons investors should not invest in Vanguard VMFXX and alternatives investors may want to consider. Please note that, while this fixed income blog post focuses on Vanguard VMFXX, certain of the issues raised (such as the use of 7-day yields and money market fund distributions being tied to the fed funds rate) pertain to other money market funds as well.

- 7-day yields mislead investors: The much-advertised VMFXX 7 day yield misleads investors. It takes the fund's accrued interest over the last week and multiplies it by 52. The VMFXX yield does not accurately represent an investor's expected annual return in the way yields of individual corporate bonds do.

- Lower money market yields likely: According to the December 2025 Fed dot plot, the US Federal Reserve is projecting an additional 0.50 percentage points of Fed rate cuts by the end of 2027. Should this occur, Vanguard VMFXX investors would see their income plunge and would not benefit from the rising bond prices that could accompany such a move.

- Compelling alternatives to VMFXX: There are compelling alternatives to VMFXX that offer investors higher potential returns, fixed coupons for long durations, lower fees, and a higher level of transparency.

- VMFXX is riskier than many think: Vanguard VMFXX is not as safe as investors believe it is, as only 38% of its investments were in US Treasury obligations as of December 31, 2025. The rest were in repurchase agreements and agency obligations, two sectors previously bailed out by the US government.

- Vanguard VMFXX is not a fixed income investment: As of August 31, 2025, 62% of VMFXX's investments had maturity dates between one and thirty days, creating significant reinvestment risk and uncertain future distributions.

- The VMFXX expense ratio is understated: Bond fund expense ratios do not include the significant transaction costs they incurs to buy and sell securities. Owning individual bonds can drive significant savings compared to the recurring fees and costs incurred by VMFXX.

- Vanguard censured: In June 2023, Vanguard was fined and censured by the Financial Industry Regulatory Authority (FINRA) for overstating projected yields and annual income on nine money market funds along with other errors that went uncorrected despite 100 customer complaints.

- Vanguard misleads investors on safety of certain VMFXX holdings: The Vanguard VMFXX website indicated that, as of December 31, 2025, 32.7% of VMFXX holdings were "Government Obligations," when, instead, these investments were Federal Home Loan Banks bonds and Federal Farm Credit Banks bonds, which are not guaranteed by the US government.

REASON 1 NOT TO INVEST IN VANGUARD VMFXX

The VMFXX Yield Misleads Investors

As shown in Figure 1, the misleading VMFXX 7 day yield was 3.63% on January 21, 2026. The VMFXX yield is the first

performance-related number investors see when they visit the Vanguard Federal Money Market Fund website, but it's not a real number.

This "yield" is misleading, as the figure multiplies the fund's previous-week's income by 52 to arrive at an

annualized "yield." Imagine buying a stock and making 10% in one week. In the land of money-market lingo, you would

have a 7 day yield of 520%.

In under 18 months, the Vanguard VMFXX 7 day yield had fallen 1.69 percentage points from where it was on August 1, 2024. The

VMFXX yield is a "hypothetical" number, as discussed below, and does not represent the income investors will receive

over the next year -- or even the next month. All bond fund investors must understand that income from these

investments is not contractual. Bond funds, including Vanguard VMFXX, are not a substitute for individual bonds that pay a specific amount of

coupon interest every six months.

Figure 1: "Above-the-fold" Area of Vanguard VMFXX Website

Source: Numbers provided by Vanguard.com. Graphics created by Bondsavvy.

VMFXX Dividends Have Been Falling

While Vanguard uses the VMFXX 7 day yield as a key part of marketing the fund, VMFXX dividends are paid monthly -- not weekly. Even as the VMFXX yield has drastically fallen, money has continued to pour into this fund. We believe a big reason for this is many investors equate the VMFXX yield with a true bond yield. This is a huge mistake investors keep making.

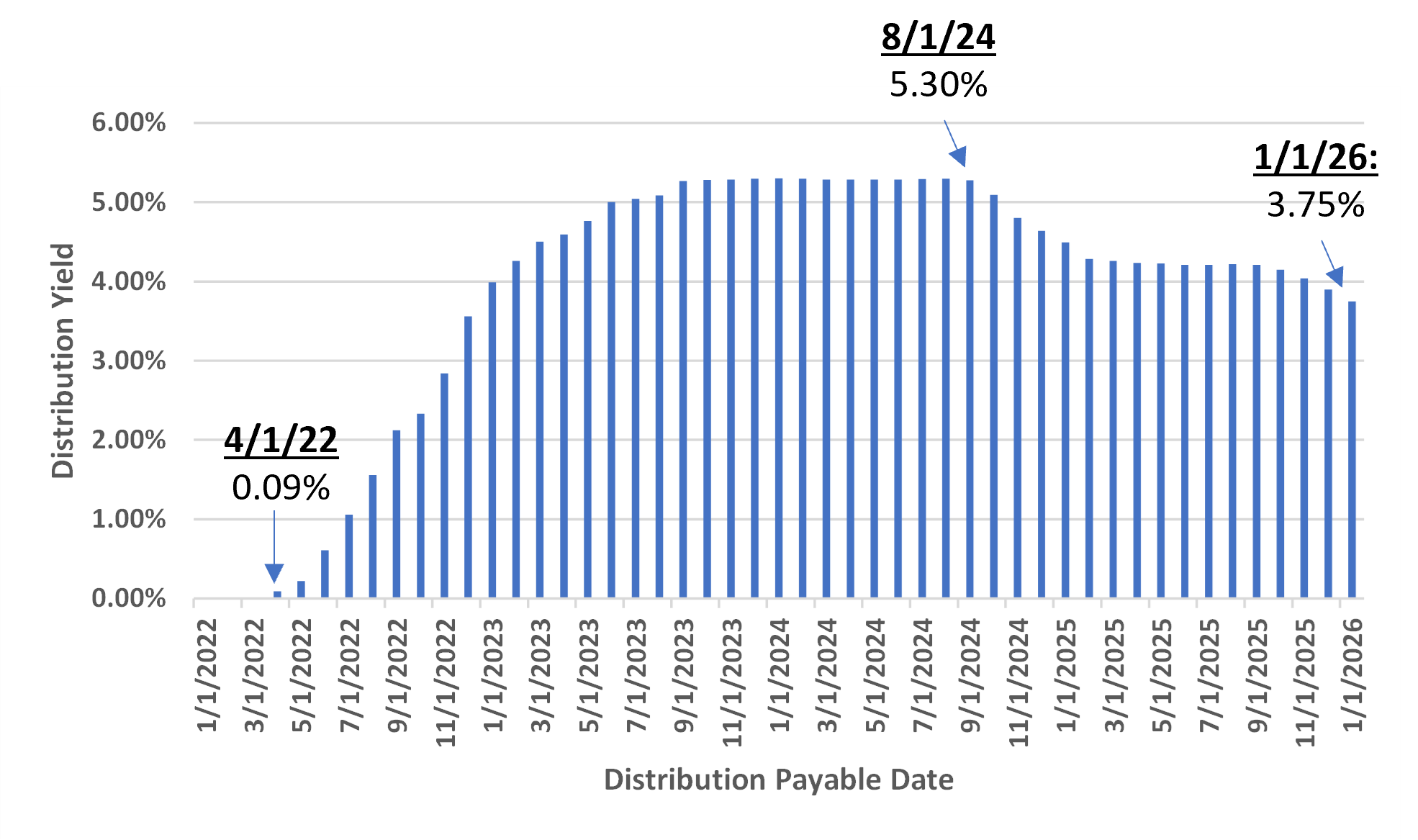

Figure 2 shows the monthly VMFXX dividend history from January 3, 2022 to January 1, 2026 and how the VMFXX distribution yield has fallen from 5.30% to 3.75% between August 1, 2024 to January 1, 2026. The distribution yield takes a month's dividend per share, divides it by the number of days in the month, and then takes that quotient and multiplies it by 365 days in the year.

Figure 2: VMFXX Dividend History -- January 3, 2022-January 2, 2026

Source: Vanguard data charted by Bondsavvy.

Bondsavvy Subscriber Benefit

Steve Shaw founded Bondsavvy in 2017 to make bond investing easy and more profitable for individual investors. Our corporate bond recommendations cut through the clutter to identify bonds that

offer high coupons and upside potential relative to their risk.

Get Started

VMFXX Dividends Can Vary Significantly Each Month

Corporate bond issuers have a contractual obligation to bondholders to pay a specific amount of coupon interest on specific dates. This provides security on which income investors can depend and plan.

VMFXX dividends, on the other hand, are unreliable and inconsistent -- not what the doctor ordered for an income investment. When interest rates were low, the VMFXX yield was close to zero, as shown in Figure 2. While the VMFXX yield is higher now, the distribution yields shown in Figure 2 are monthly figures that can change quickly.

As of August 31, 2025, 44.6% of VMFXX holdings had maturities of one to seven days. Therefore, a significant portion of Vanguard Federal Money Market Fund investments are replaced during the month. As this happens, the monthly VMFXX distribution yield shown in Figure 2 could vary from the advertised VMFXX 7 day yield.

Changing interest rates and the mismatch between the VMFXX 7 day yield and actual VMFXX dividends paid create a high level of uncertainty for Vanguard Federal Money Market Fund investors.

The VMFXX 7 Day Yield Is Based on "Hypothetical Income" per Vanguard

As shown in Figure 1, there are blue hyperlinks regarding the "7 day SEC Yield" Vanguard VMFXX site visitors can

click for more information. These hyperlinks provide the following information on the VMFXX yield. If you need to

read it multiple times for it to make sense to you, you're not alone. We have added italics to emphasize certain

areas.

Figure 3: Vanguard's explanation of the VMFXX 7 Day SEC Yield

SEC Yield

"A non-money market fund's SEC yield is based on a formula developed by the SEC. The method calculates a fund's

hypothetical annualized income as a percentage of its assets.

A security's income, for the purposes of this calculation, is based on the current market yield to maturity (for

bonds) or projected dividend yield (for stocks) of the fund's holdings over a trailing 30-day period. This

hypothetical income will differ (at times, significantly) from the fund's actual experience. As a result, income

distributions from the fund may be higher or lower than implied by the SEC yield.

The SEC yield for a money market fund is calculated by annualizing its daily income distributions for the previous

7 days."

Got all that?

As noted above, advertising the Vanguard Federal Money Market Fund 7 day yield is tantamount to an investor owning a corporate bond that

went up 10% in one week and touting a 520% investment return. The only difference being that the bond investor with

the 10% one-week return achieved an actual return, and the investor could sell her bonds after one week at a

10% profit.

Yes, Vanguard does disclose how it calculates the VMFXX yield in a hyperlink; however, given the prominent position

Vanguard accords the VMFXX yield in its advertising materials, it's no wonder many investors falsely believe the

VMFXX yield and a bond's YTM are similar metrics.

REASON 2 NOT TO OWN VANGUARD VMFXX

The Fed Is Projecting Interest Rates To Fall 0.50% by Year-End 2027, Which Would Further Lower the VMFXX Yield

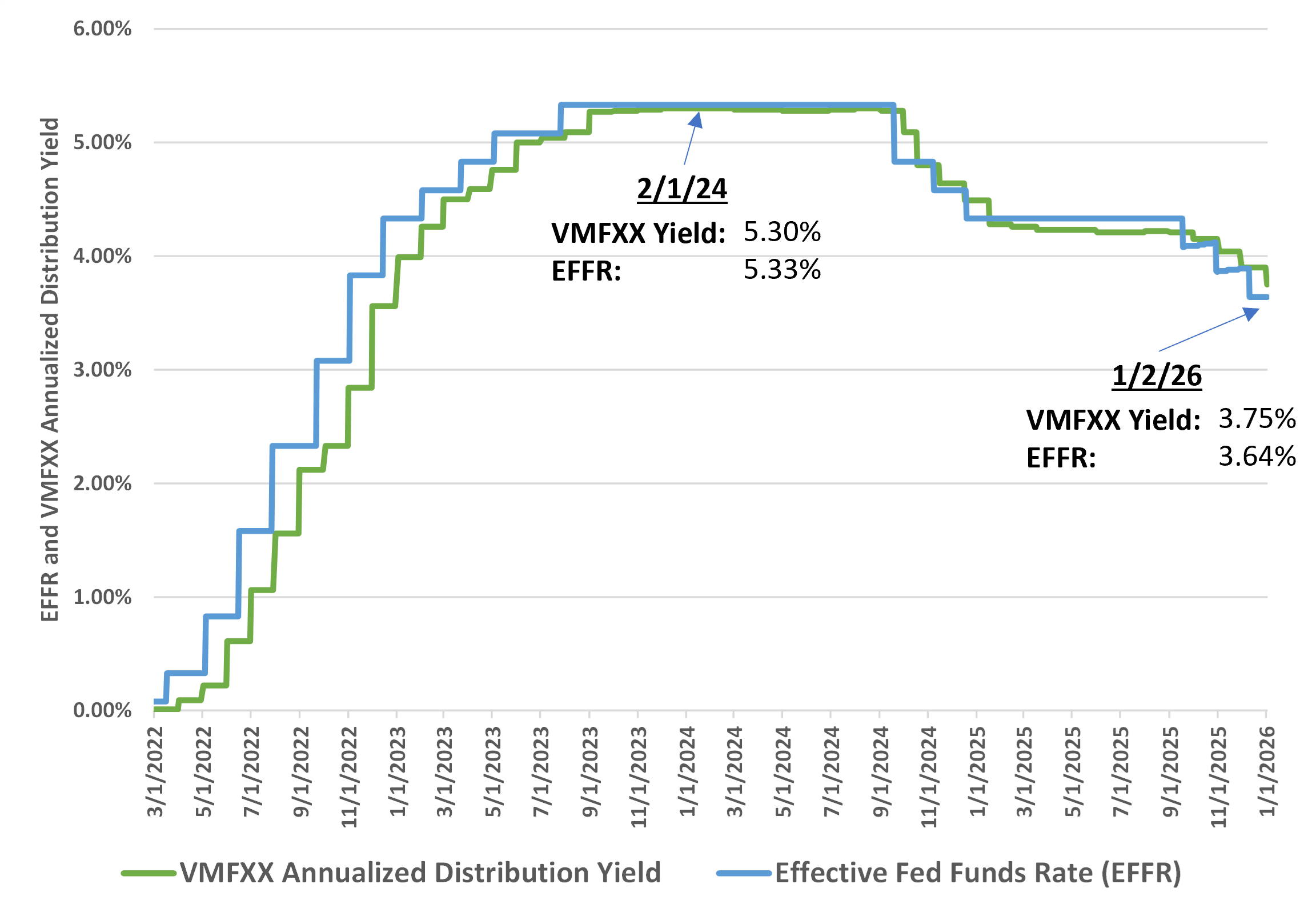

The VMFXX yield is closely tied to the US federal funds rate, which is set by the US Federal Reserve's Federal Open

Market Committee ("FOMC"). As the US Federal Reserve raised the target fed funds rate 5.25 percentage points (or 525

"basis points" or "bps") from March 2022 to July 2023, the VMFXX yield followed suit, as shown in Figure 4. When the

Fed then lowered the target range of the fed funds rate by 0.5 points on September 18, 2024, the October 1 and

November 1, 2024 VMFXX distributions also fell. The November 1, 2024 VMFXX dividend fell 0.50 points from 5.30% on

August 1, 2024 to 4.80% on November 1, 2024. The VMFXX yield also fell after the 0.25-point Fed rate cuts on

November 7 and December 18, 2024.

As shown in Figure 4, the VMFXX monthly distribution yield has fallen 155 basis points from 5.30% on February 1, 2024 to 3.75% on January 2,

2026. Since the Fed lowered interest rates at the December 10, 2025 FOMC meeting, the January 2, 2026 distribution included the earlier portion of December 2025 before rates were lowered. We expect the January 2026 VMFXX distribution yield to be approximately 3.60%.

This yield is variable and will change over time. As discussed later in this section, the Fed, per the December 2025 Fed dot plot, is projecting the target range for the fed funds rate

to fall to 3.00% to 3.25% by yearend 2027. Given the close correlation between the fed funds rate and the VMFXX

yield, the VMFXX yield would fall to approximately 3.10% should the Fed follow through with these interest rate cuts.

Figure 4: VMFXX Distribution Yield vs. Effective Fed Funds Rate ("EFFR") -- March 1, 2022-January 2,

2026

Sources: Vanguard.com and the Federal Reserve Bank of New York.

Not only would reductions in the fed funds rate lower the VMFXX yield, but also VMFXX investors would not benefit

from any bond price increases potentially driven by lower interest rates.

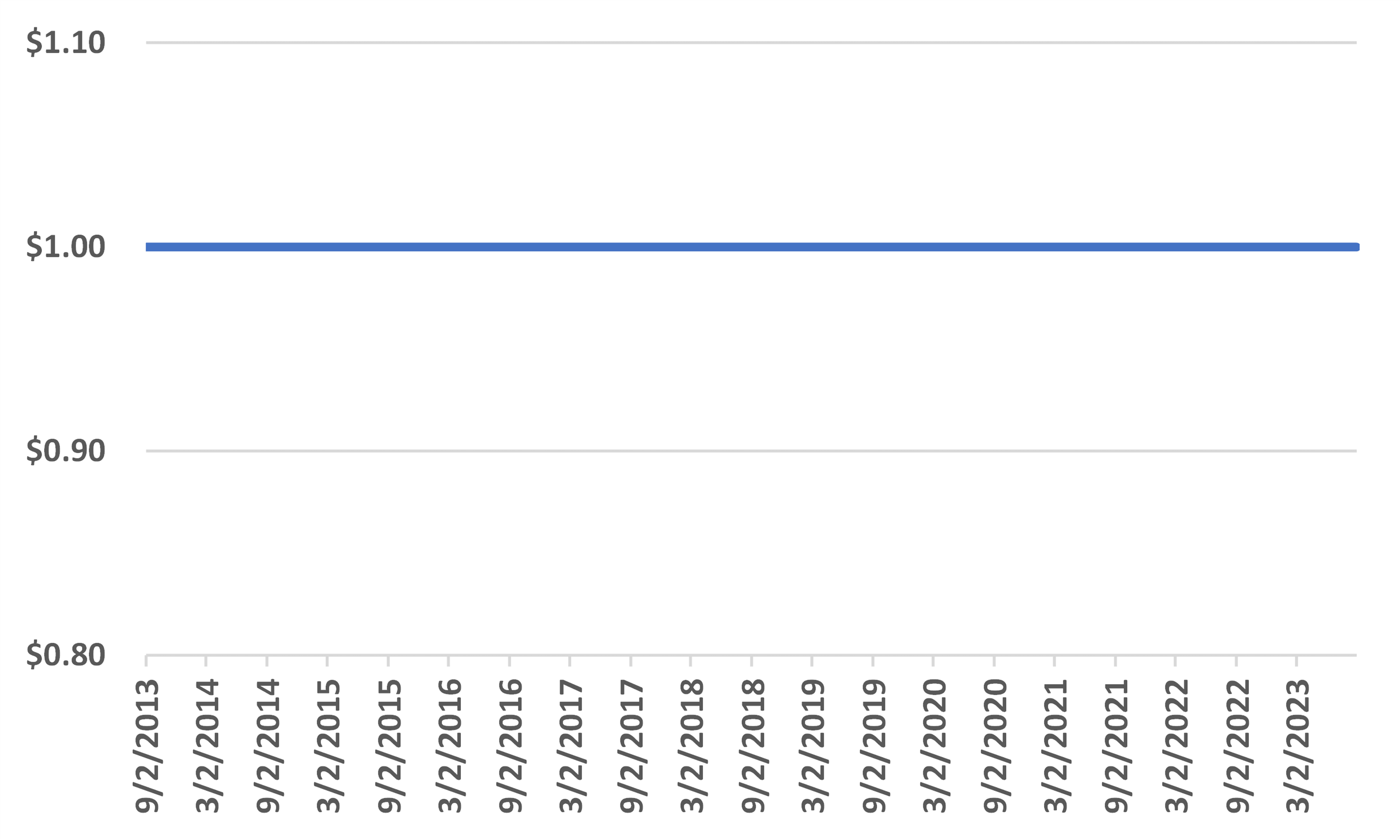

VMFXX Returns Are 100% from Income

With Vanguard Federal Money Market Fund, the only return it generates is from income, as the fund seeks to maintain a $1.00 net asset

value per share every day. There is no such thing as capital appreciation opportunities with Vanguard VMFXX.

Figure 5 shows the daily closing price of Vanguard Federal Money Market Fund for the ten years ending September 2, 2023:

Figure 5: Vanguard VMFXX Closing Price -- September 2, 2013-September 2, 2023

Source: Yahoo! Finance.

While Vanguard Federal Money Market Fund lacks the upside of bonds, especially those trading at a significant discount to par value

today, is also generally lacks the pricing volatility. That said, since income generates 100% of Vanguard Federal Money Market Fund returns, the

variability of VMFXX dividends can make VMFXX less compelling than individual bonds, which offer fixed coupon

payments until a specified maturity date.

Further, long-term US capital gains tax rates can be lower than a person's marginal income tax rate, which can drive higher after-tax returns for investments with capital gain opportunities.

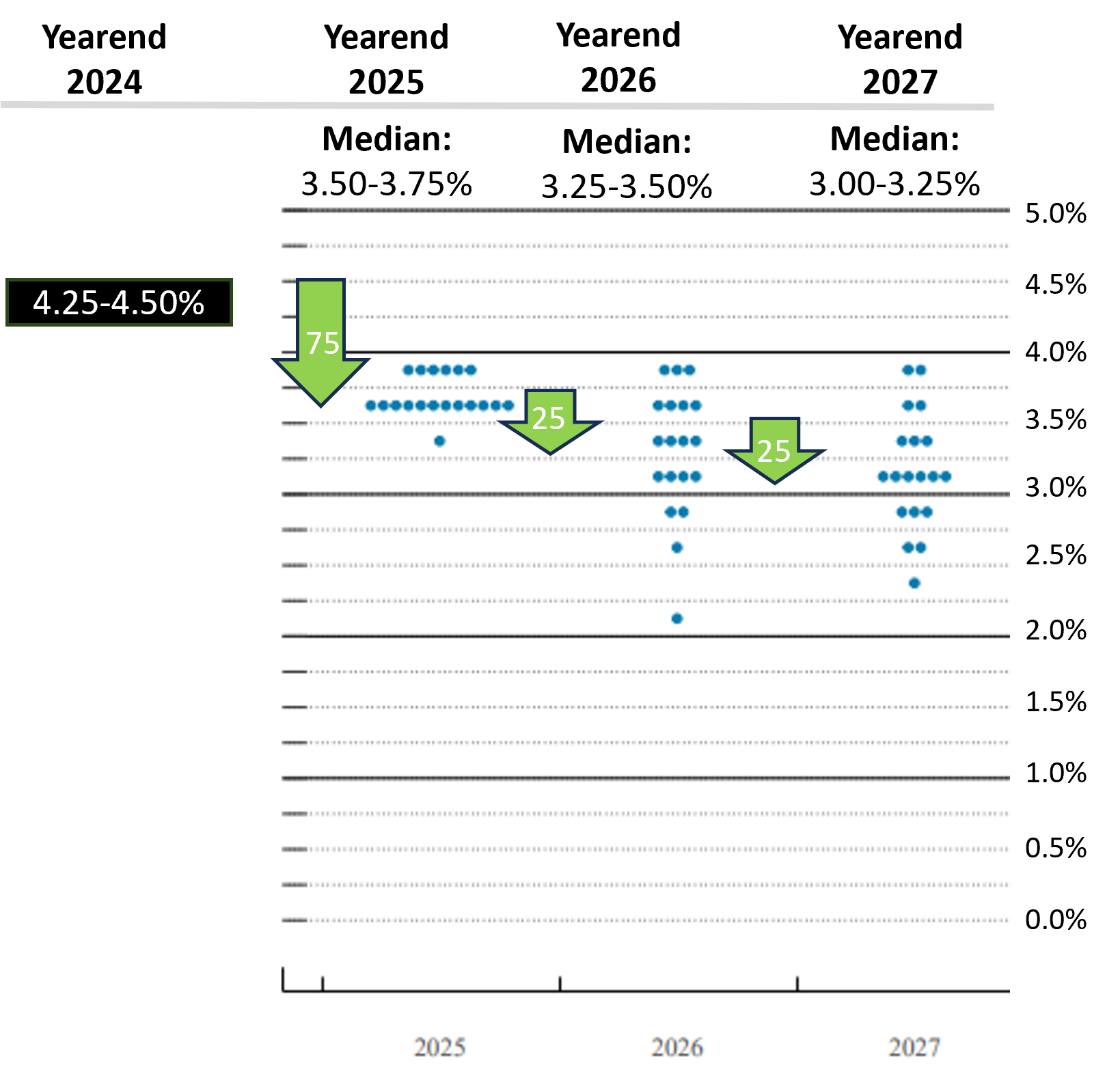

The Latest Fed Dot Plot Shows the Fed Funds Rate Falling

0.50 Percentage Points by Yearend 2027

Each quarter, the US Federal Reserve publishes the FOMC Summary of Economic Projections, the most recent of which it

released December 10, 2025.

While there are only 12 voting members of the FOMC at any given time, all 19 FOMC participants provide economic

projections that are summarized in the FOMC Summary of Economic Projections. Included in these projections are 1)

changes in GDP, 2) the unemployment rate, 3) PCE inflation, 4) Core PCE inflation, and 5) the fed funds rate.

Watch Steve Shaw present “What to Know Before Investing in Bonds.”

Get Free Video

Figure 6 shows the FOMC participants' projections for the fed funds rate, which are also known as the Fed dot plot.

Each dot represents an estimate from one FOMC participant. Above each set of dots, we show the median projection for

each year-end. Per the December 2025 Fed dot plot, the median estimate for the fed funds rate falls from 3.50-3.75% as of December 10, 2025 to 3.00-3.25% at the end of 2027.

Source: December 10, 2025 US Federal Reserve Summary of Economic Projections.

Of course, within the 19 Fed dot plot dots, we do not know which 12 will vote at future meetings, but this gives us

the best estimate of where all FOMC participants' heads were at on December 10, 2025. Based on the December 2025 Fed dot

plot, the Fed is expected to drop the fed funds rate by 25 basis points in 2026 and 25 basis points 2027.

As the fed funds rate falls, we expect the VMFXX yield to fall in lockstep.

REASON 3 NOT TO BUY VANGUARD VMFXX

There Are Alternatives to VMFXX That Offer Higher Potential Returns, Higher Credit Quality, and Lower

Fees

All investments have weaknesses and drawbacks. We discuss corporate bonds advantages and disadvantages

relative to bond funds, corporate bonds vs. municipal bonds, and corporate bonds vs. stocks in separate Bondsavvy fixed income blog posts.

In this section, we will compare Vanguard VMFXX to other investment alternatives, including select US Treasurys and

individual corporate bonds. Bondsavvy does not provide personalized advice, so certain pros and cons may be more or

less applicable to different investors.

Select Corporate Bonds Offer Higher Potential Returns and Credit Quality Than Vanguard Federal Money Market Fund

Figure 6a shows yields to maturity (YTMs) of select corporate bonds of different maturity dates. Since there is no Vanguard Federal Money Market Fund maturity date or fixed coupon rate, there is no Vanguard VMFXX yield to maturity. With the individual

bonds, however, we can see there are compelling alternatives to VMFXX.

Higher Potential Returns of US Treasurys and Select Corporates vs. VMFXX

For example, on January 22, 2026, an investor could purchase a 4.3-year Walmart bond (CUSIP 931142FN8) with a 3.96% YTM. The Walmart '30 bond enables

investors to lock in a near-4% yield for the next 4.3 years and, should the price rise in the near term,

achieve a higher return than the quoted YTM. While the Vanguard Federal Money Market Fund 7 day yield was 3.63% on January 21, 2026, that yield is

not fixed. Should the fed funds rate fall to 3.00-3.25% by year-end 2027, as projected by the December 2025 Fed dot plot,

the VMFXX yield would fall to about 3.10%, well below the Walmart '30 bond's yield to maturity.

As noted above, corporate bonds can achieve total returns that can exceed their YTMs, as we discuss in our fixed income strategy page and demonstrate in our corporate bond returns page.

Figure 6a: Comparison of VMFXX to Select US Corporate Bonds. Pricing as of 4:30pm EST on January 22, 2026

Investment |

Years to Maturity

from 1/22/2026 |

CUSIP |

YTM* |

Price as %

of Par Value*

|

Bond Rating

|

Min Quantity* |

| Vanguard VMFXX |

No maturity date |

922906300 |

N/A |

N/A |

N/A |

$3,000 |

| Walmart 4.35% 4/28/30 |

4.3 years |

931142FN8 |

3.96% |

101.52 |

Aa2/AA |

$2,000

face value |

| US Treasury 3.00% 2/15/47 |

21.1 years |

912810RV2 |

4.87% |

75.54 |

Aa1/-- |

$5,000

face value |

| Microsoft 4.25% 2/6/47 |

21.1 years |

594918CA0 |

5.15% |

88.54 |

Aaa/AAA |

$2,000

face value |

| Fedex 4.40% 1/15/47 |

21.0 years |

31428XBN5 |

5.95% |

81.52 |

Baa2/BBB |

$2,000

face value |

*Source: Fidelity.com

Investors looking to lock in yields for a longer time period and to have opportunities for capital

appreciation could evaluate longer-dated corporate bonds. Microsoft has a higher credit rating than the US Treasury,

and the Microsoft 4.25% 2/6/47 bond had a YTM on January 22, 2026 that was 28 basis points (0.28 percentage points)

higher than the US Treasury bond with a similar maturity date. Should long-term US Treasury yields drop over

the coming years, we would expect both the Microsoft '47 and US Treasury '47 bonds to increase in value. Of course,

this upside potential does come with materially higher pricing volatility relative to shorter-dated bonds.

For investors seeking a higher yield and who are willing to invest in bonds rated below the highest-rated bonds, the

Fedex 4.40% '47 bond offers a 1.08-point higher yield compared to the Microsoft '47 bond. In addition, should

long-term US Treasury yields fall by one percentage point in the near term, assuming no change in credit spread, we would

expect the Fedex '47 bond price to increase approximately 10 points.

None of the investments in Figure 6a are currently on the Bondsavvy investment recommendation list. Purchase a Premier Bondsavvy subscription to see all of our current and past corporate

bond recommendations. Read our How To Build a

Bond Portfolio blog post for ten dos and don'ts on building a fixed income portfolio.

Higher Credit Quality of US Treasurys and Select Corporate Bonds vs. VMFXX

VMFXX does not have a bond

rating; however, we believe individual bonds issued by the US Treasury and high-credit-quality companies

such as Microsoft have higher creditworthiness than the repo- and GSE-debt-heavy VMFXX. Further, sometime between

February 28, 2025 and April 30, 2025, Vanguard VMFXX introduced investments in Yankee/foreign bonds. We have seen limited disclosures as to what specific bonds these are, which raises further questions on what VMFXX investors are

actually getting.

In the case of US Treasury and Microsoft bond investments, investors know exactly what they are investing in

and can assess the risk and potential return. As shown throughout this article, the VMFXX holdings are always

changing, and its credit quality has fallen as the amount of US Treasury investments has become a lower percentage

of the fund's investments.

US Treasurys and Corporate Bonds Offer Lower Fees Than VMFXX

Even as VMFXX's net asset value has grown from $38.8 billion on August 31, 2016 to $381 billion on December 31, 2025,

the Vanguard Federal Money Market Fund expense ratio has held steady at 0.11%. When adding in transaction costs not disclosed by the fund, the

actual expense ratio is likely closer to 0.15%.

These VMFXX fees are recurring and don't go away.

On the other hand, online bond investors

who own US Treasurys generally do not pay to buy and sell Treasurys and do not incur recurring management fees.

Corporate bond investors will pay transaction fees, generally $1 per $1,000 face value

per bond on online bond trading platforms. Of course, corporate bond

investors who hold bonds to maturity would only pay the transaction fee when they purchase the bond.

Despite the Vanguard drumbeat of it being the "low-cost provider," as shown in Figure 6b, VMFXX fees are

substantially higher than those incurred by investors in individual bonds. Figure 6b shows an illustrative

example of the fees incurred by online bond investors vs. those of Vanguard Federal Money Market Fund for an initial $50,000 investment.

We show two cases for VMFXX: one with the reported 0.11% VMFXX expense ratio and another with an illustrative 0.15%

expense ratio, which we believe closer reflects the all-in expense ratio when transaction costs are included.

Figure 6b: Illustrative Investment Fee Analysis for Initial $50,000 Investment

Investment |

Fees Over

Five Years |

Assumptions |

| VMFXX Expense Ratio @ 0.11% |

$299 |

Annual year 1-5 returns of 3.60%, 3.35%, 3.10%, 3.10%, and 3.10%, respectively |

| VMFXX 0.15% All-in Expense Ratio |

$408 |

Same return assumptions; however, we assume a higher 0.15% VMFXX expense ratio to account for VMFXX

transaction costs |

| Online US Treasurys |

$0 |

Generally, online bond trading platforms do not charge transaction fees for US Treasurys |

| Online Corporate Bonds: Hold to Maturity |

$50 |

$1 per $1,000 of face value paid at purchase |

| Online Corporate Bonds: Sell Bonds Before Maturity |

$100 |

$1 per $1,000 of face value paid at purchase and sale |

Source: Bondsavvy calculations.

Since Vanguard charges expenses on the total amount invested in Vanguard Federal Money Market Fund, we make five-year VMFXX investment return

assumptions. Individual bond fees are off the face value, so the transaction fees do not change if the bond price

increases or decreases in value.

As noted above, US Treasurys are generally free to trade on online bond platforms. For corporate bonds, an investor

holding a $50,000 investment to maturity would incur $50 of transaction costs at purchase. An investor selling bonds before maturity would incur the

$50 charge during both the purchase and sale transactions.

REASON 4 NOT TO OWN VANGUARD VMFXX

Vanguard VMFXX Is Not as Safe as Many Think It Is

We believe investments in individual US Treasurys and the highest-quality US corporate bonds (think Alphabet,

Microsoft, and Wal-Mart) represent a higher credit quality than that of Vanguard VMFXX. As of August 31, 2025, 67.9% of

VMFXX investments were held in either 1) repurchase agreements (also known as "repos;" we will discuss more about

these later) and 2) bonds of government-sponsored entities (GSEs) such as the Federal Home Loan Banks ("FHLB") and

Federal Farm Credit Banks Funding Corp. ("Farm Credit Banks").

The repo market was bailed out by the US Federal Reserve in September 2019 and certain GSEs, such as Fannie Mae, were

bailed out by the US government during the 2008 Financial Crisis. The bonds of GSEs such as FHLB and Farm Credit

Banks are not guaranteed by the US government despite Vanguard referring to them as "Government Obligations"

on the VMFXX website.

US Treasurys Are Only 32% of VMFXX and Investments Can Swing Wildly Across Asset Classes

One of the many benefits of owning individual bonds vs. bond funds is that

individual bond investors know exactly what they are investing in. Bond fund investors, on the other hand,

are at the whim of money managers such as Vanguard, as the composition of mutual funds and ETFs can change by the

day.

As of August 31, 2025, the breakdown of VMFXX holdings by asset class was: repurchase agreements (32.0%), GSE

obligations (35.9%), and US Treasury bills (32.0%). As shown in Figure 7, the

composition of Vanguard Federal Money Market Fund has changed dramatically through the years. In short, investors seldom know what they

are getting.

Figure 7: VMFXX Portfolio Composition -- August 31, 2016-August 31, 2025

Source: Vanguard SEC filings and public information. Bondsavvy calculated percentages for August 31, 2020, 2021,

2022, and 2024 based on Vanguard filings.

Per Figure 7, repurchase agreements represented only 6.3% of VMFXX holdings on August 31, 2020, but then repos

skyrocketed to 64.0% of Vanguard VMFXX on August 31, 2022. US Treasury obligations reached a high of 75.9% on August

31, 2020; however, by August 31, 2022, US Treasury obligations accounted for only 16.6% of VMFXX holdings.

Few Individual Investors Understand Repurchase Agreement Risks

Before making any investment, individual investors must ask themselves if they truly understand its risks and

potential returns.

As shown in Figure 7, investors do not know, from day to day, what is held in VMFXX. The largest holdings have

recently been in repurchase agreements, which we believe are investments understood by few individual investors. The

Wall Street Journal has an excellent repo market explainer video for those looking to gain a better understanding. The video also

reviews how the Federal Reserve had to bail out the repo market in September 2019.

Each repo agreement Vanguard VMFXX enters into is with a counterparty, whereby VMFXX lends cash to either a

commercial bank or the Federal Reserve Bank of New York. Like the holdings of VMFXX, its counterparties are also

changing over time. For example, on August 31, 2016, the Federal Reserve Bank of New York was the counterparty in

26.3% of VMFXX repurchase agreement investments compared to 95.0% on August 31, 2022.

Watch Steve Shaw present “What to Know Before Investing in Bonds.”

Get Free Video

Per Vanguard VMFXX's Form N-MFP2 filed with the US Securities and Exchange Commission ("SEC") on September 8, 2023,

select repurchase agreement counterparties included Credit Agricole Corporate & Investment Bank SA, TD

Securities (USA) LLC, Sumitomo Mitsui Banking Corp., and Standard Chartered Bank.

While Vanguard VMFXX repurchase agreements are typically collateralized with US Treasury obligations, there is still

counterparty risk. The exposure to each counterparty regularly changes, so it's quite difficult for investors to

assess the risk of these repurchase agreements. Given that repurchase agreements were Vanguard VMFXX's largest

investment as of August 31, 2024, individual investors must ask themselves whether putting money into such a

repo-heavy fund is a good move.

REASON 5 NOT TO OWN VANGUARD FEDERAL MONEY MARKET FUND

VMFXX Is NOT a Fixed Income Investment Given Its Ultra-Short-Term Holdings

For an investment to be considered "fixed income," there needs to be some element of "fixed" to it. Fixed income

investments come in all shapes and sizes, from a 1 month US Treasury bill to a 30 year Microsoft corporate bond.

As discussed above, the VMFXX yield is a hypothetical number given how quickly interest rates can move and the

short-term nature of its investments. Investors who own a 5 year corporate bond with a YTM of 5.50% know the amount

of interest they will receive between now and maturity, the dates of such interest payments, and the date and amount

paid at maturity.

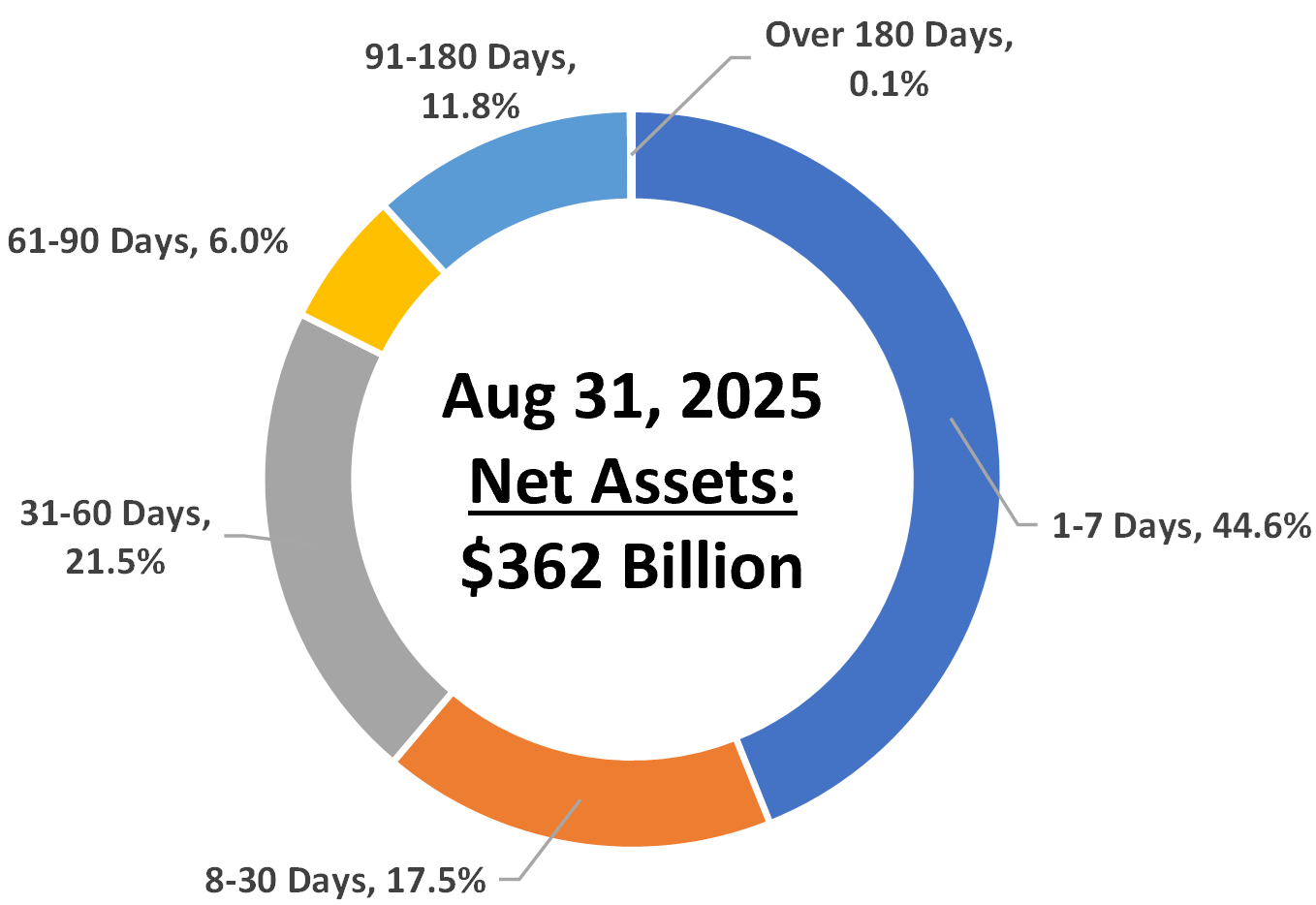

All of these facts are unknown to Vanguard Federal Money Market Fund investors. As shown in Figure 8, on August 31, 2025, 44.6% of

Vanguard VMFXX's investments were in securities with maturity dates between one and seven days. Since nearly

half of the portfolio matures each week, these investments will need to be replaced with other investments

that are unknown to VMFXX investors. The yields of these incoming investments are unknown to investors, making

guesswork of future VMFXX dividends.

Figure 8: Vanguard VMFXX Maturity Date Distribution on August 31, 2025

Source: Vanguard Money Market Funds Annual Report dated August 31, 2025. Figures sum to 101.5%, as they do not

adjust for -1.5% of "other assets and liabilities -- net."

In addition to VMFXX's high portfolio turnover that limits visibility of the VMFXX yield, it also significantly

increases the transaction costs Vanguard VMFXX incurs to purchase new investments and sell existing ones. Despite

knowing what these transaction costs are, Vanguard does not disclose them to investors.

While Vanguard likes to tout funds with 'low expense ratios' like the 0.11% VMFXX expense ratio, we believe the

actual costs investors incur to invest in Vanguard VMFXX are materially higher than the VMFXX expense ratio,

as we discuss further in Reason 6.

REASON 6 NOT TO OWN VANGUARD VMFXX

Vanguard Understates VMFXX Expenses by Not Disclosing VMFXX's Transaction Costs

Vanguard has built its business on claiming to be a "low-cost provider" of mutual fund and ETF products. The problem

with this is that the VMFXX expense ratio of 0.11% for the year ended August 31, 2025 excludes one of the most basic

costs of operating a mutual fund: securities transaction costs.

All bond fund managers know what these costs are, as they all have Transaction Cost Analysis (TCA) reports that will

show their transaction costs down to the penny. Somehow, however, the Big Money lobby has convinced regulators that

funds don't have to disclose this material cost of doing business. Buying and selling securities is fundamental to

managing money. Funds need to disclose these costs so investors understand the true cost of investing in

mutual funds and ETFs.

Figure 9: Big Money Lobbyist Convinces Government That Bond Funds Shouldn't Disclose Transaction Costs to Investors

In Vanguard VMFXX's case, there is a table in the fund's annual reports that shows calculations of the VMFXX expense

ratio. If you read the fine print, however, you will see "Note that the expenses shown in the table are meant to

highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund

for buying and selling securities."

This is tantamount to a retailer not reporting the cost of transporting products to its stores. Reporting the VMFXX

expense ratio before transaction costs is a practice that needs to end. Please note that the practice of not reporting transaction costs is a problem with the entire fixed income management industry and is not limited to Vanguard.

How Much Is the Vanguard VMFXX Expense Ratio Before Transaction Costs?

On August 31, 2025, VMFXX reported a net asset value of $362 billion, a 17% year-over-year increase. It reported "total expenses" of $374.1 million

for the 12 months ending on the same date, an 18% increase from the prior year. These expenses included $342.5 million of "Management and Administrative" expense and $20.2 million for "Marketing and Distribution" expense.

This, of course, excludes transaction costs, which are likely significant given the high VMFXX portfolio turnover

driven by the ultra-short maturities of its holdings.

Investors in Individual Bonds Can See All the Costs They Incur

When investors buy bonds online,

they can see all the costs they incur, including the bid-ask spread and any brokerage commissions. For most online

brokerages, buying and selling US Treasurys is free. If an investor is looking for a short-term place to put money,

short-dated US Treasurys that have no trading costs could offer advantages compared to Vanguard VMFXX. Corporate

bonds also offer advantages over VMFXX. We compared VMFXX to select US Treasurys and corporate bonds in Reason 3

of this fixed income blog post.

REASON 7 NOT TO OWN VANGUARD VMFXX

As reported in Investment News on May 23, 2023, FINRA ordered Vanguard to pay $800,000 for "issuing misleading

account statements to money market customers and failing to respond to [the customers] when they indicated something

was wrong." According to the May 2023 FINRA Order, Vanguard overstated the estimated yield and annual income for certain

money market funds on approximately 8.5 million account statements. This occurred from November 2019 to September

2020.

Example of Vanguard VMFXX Yield Being Miscalculated

As noted in an example provided in the FINRA Order, in September 2020, Vanguard account statements displayed an

estimated VMFXX yield of 1.87%, when it was actually 0.06%, or 31 times less. From November 2019 to October 2020,

approximately 50 customers contacted Vanguard to alert it of the miscalculated VMFXX yields.

Figure 10: Vanguard customer realizes VMFXX yield on his statement was 31x higher than actual

According to the FINRA Order, Vanguard "failed to promptly investigate whether the yield data used to calculate the

estimated yield and estimated annual income for money market funds on account statements was correct." It wasn't

until October 2020 -- 11 months after the first customer complaint -- that Vanguard corrected the error.

Figure 11: Vanguard Management Ignored Repeated Calls from Customers on Incorrect VMFXX Yields

Other Vanguard Investment Returns Miscalculations

Vanguard was fined for errors in other investment returns calculations as part of the FINRA Order.

In one set of errors, if a customer deposited a check into an account on the last business day of the month, the

statement's performance area recorded this deposit as an increase in market value instead of an account deposit. The

subsequent monthly statement would then record the deposit as a loss in market value. This error, according to the

FINRA Order, affected approximately 23,000 statements from at least October 2019 until May 2021.

From October 2019 to March 2021, Vanguard received 50 customer calls and emails regarding this issue and one other

related to account inaccuracies in the case of corporate actions such as stock splits. Again, these myriad customer

calls resulted in no action by Vanguard until it finally corrected the errors in May and June 2021.

While we don't believe these errors are as serious as Vanguard misstating Vanguard money market yields on over 8

million account statements, Vanguard's yearslong lack of prompt corrective action should be of concern to investors.

Glacial Carriage of Justice and a Slap on the Wrist for Vanguard

From the first knowledge of money market yield calculation issues in November 2019, it took nearly four years for

Vanguard to have to pay a fine related to this matter. While some fine is better than none, $800,000 seems light

when compared to the $287.5 million Vanguard VMFXX charged investors in "Management and Administrative" fees for the

year ending August 31, 2024.

If an $800,000 fine and related censure is the only consequence, it's doubtful such 'punishment' is enough to thwart

similar behavior in the future. After all, Vanguard knew about its errors as far back as 2019, but it elected to do

nothing. This is inexcusable.

While 50 Vanguard customers contacted the company to alert it of the money market yield issues, hundreds of thousands

did not. They likely saw the high yields on their statements and may have invested more money into Vanguard VMFXX.

While we hope this episode caused Vanguard to address these and similar issues, the long-delayed rounding-error fine

and corresponding censure don't seem like much of a deterrent.

REASON 8 NOT TO OWN VANGUARD VMFXX

Vanguard Misleads Investors by Calling GSE Debt a "Government Obligation"

As feared and expected, Vanguard appears to be 'right back at it,' this time by referring to debt issued by

government-sponsored entities (GSEs) as "Government Obligations" when such debt is not a government

obligation. This is the classic Vanguard marketing machine, where it seeks to have investors believe an investment's

risk is lower than it actually is. If it has to pay a small fine and have some professional embarrassment while

getting people to invest billions in VMFXX, so be it.

Vanguard's mischaracterizing GSE debt as a government obligation and its ignorance of the 100 customer complaints

discussed in Reason 7 raise legitimate concerns over Vanguard's values and culture.

GSE Debt Is NOT a US Government Obligation

VMFXX holds tens of billions in bonds issued by Federal Home Loan Banks ("FHLB") and Federal Farm Credit Banks

Funding Corp. ("Farm Credit Banks"). As previously explained on the Federal Housing Finance Agency website, in the "Consolidated Obligations" section, the FHLB

bonds "are not guaranteed or insured by the federal government."

Figure 12 shows a screenshot taken of the Vanguard VMFXX, which shows the fund's alleged weighted exposures to

different types of investments. As highlighted, it indicated 32.7% of the fund's investments were "US Govt.

Obligations" even though these were bonds issued by FHLB and the Farm Credit Banks, which are not guaranteed

by the US government.

Figure 12: Screenshot of Vanguard Website Showing Alleged Vanguard VMFXX Investment Exposures as of December 31,

2025

Source: Vanguard VMFXX website

In Figure 13, we have excerpted a portion of the Schedule of Investments shown in the Vanguard Money Market Funds

February 28, 2025 financial statements. On other pages of its Schedule of Investments, Vanguard provides detail on

VMFXX's repurchase agreements and the US Treasurys it owns. We show Figure 13 so that investors are clear on what

investments, summarized in Figure 12, Vanguard is mischaracterizing as "US Govt. Obligations."

Figure 13: Excerpt of VMFXX Schedule of Investments -- February 28, 2025

Source: Vanguard Money Market Funds financial statements, February 28, 2025.

Vanguard Federal Money Market Fund wants to appear as safe as possible, which is why its website refers to GSE debt as a government

obligation even though it is not. This misleads investors.

The VMFXX website is the most public place Vanguard provides information on VMFXX. We urge Vanguard to correct this

issue so it does not continue to mislead investors.

We are big proponents of understanding what you are investing in. Given the large concentration of FHLB bonds within

Vanguard VMFXX, we encourage investors to study FHLB

financial information prior to making investments into VMFXX.

Conclusion on Eight Reasons Not To Own Vanguard VMFXX

Many investors assume that money market funds such as Vanguard Federal Money Market Fund are money good and typically an optimal place to

invest short-term cash. Our analysis peels back the onion on Vanguard VMFXX to show what it is and what it is not.

We also show how certain alternatives to VMFXX could generate higher returns at a lower cost.

As Vanguard VMFXX has grown over 10x in size since August 31, 2016, the fund faces the same problems many other mega

funds face: where to invest hundreds of billions of dollars at attractive returns. In the case of Vanguard VMFXX, it

has gone the repo agreement and GSE bond route, which has worsened the fund's credit profile and reduced

transparency.

Individual investors have a task simpler than Vanguard mega funds. They can identify a select group of individual

bond investments that match their risk tolerance and investment objectives and can purchase these investments at a

low cost on online bond trading platforms. Every day they own these

investments, they can look at their brokerage accounts and know exactly what they are investing in.

VMFXX investors' 'set it and forget it' strategy can work up to a point; however, these investors must be aware of

the impact lower interest rates will have on VMFXX and the other investment options available to them.

Get Started

Watch Free Sample